Quarterly Market Comment

As an active fund manager, Octagon Asset Management prioritises high-quality research as an input to decision making. It draws on research from a range of sources, local and global. This includes research provided by Forsyth Barr. Below is its most recent Quarterly Market Comment.

Quarterly Market Comment

For the quarter ended 31 January 2026

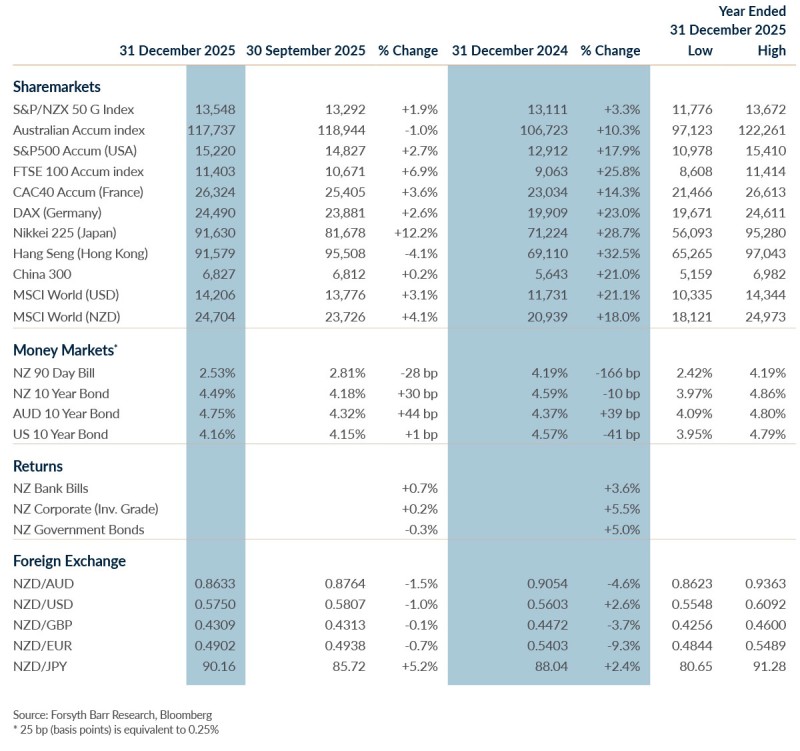

- The past three months have seen the MSCI World Index gain +3.4% in US dollar terms, but a stronger New Zealand dollar has meant local currency returns dropped -2.1%.

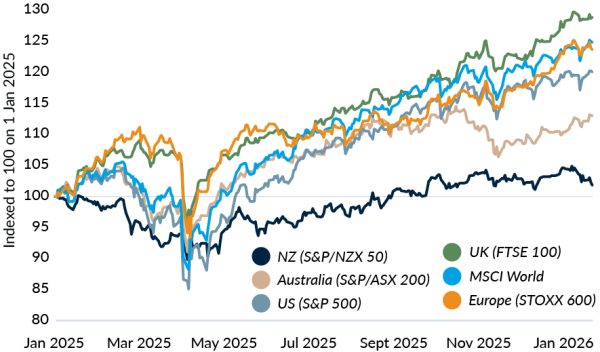

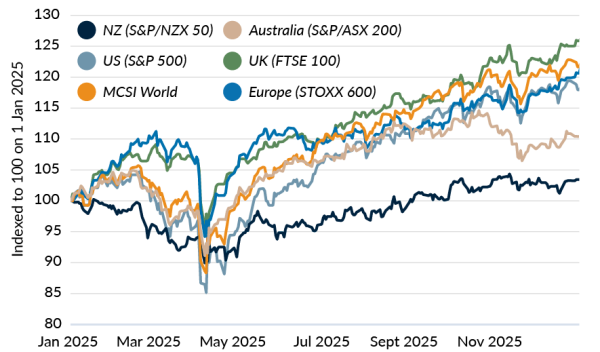

- Market performance has been mixed across regions. US equities rose +1.8%; European and UK equity markets generally delivered positive gains, with the UK market up +5.7%; NZ equities fell -0.9%, while Australian equities lifted +0.4% over the quarter.

- Fixed income returns were weaker. NZ investment-grade corporate bonds fell -0.6% for the quarter, but 12 month returns were +5.3%.

Markets stay resilient despite global uncertainty

The end of 2025 and the start of 2026 gave investors plenty to think about. Geopolitical tensions resurfaced across several regions, US trade rhetoric again made headlines, and concerns lingered around valuations in parts of the artificial intelligence (AI) market. These developments drove short bursts of volatility; however, despite the noise, financial markets proved relatively resilient.

The US economy continued to grow at a steady pace, corporate earnings held up well, and earlier interest rate cuts by major central banks helped support financial conditions. Together, these factors helped offset geopolitical uncertainty and allowed equity markets to edge higher overall.

Bond markets continued to provide diversification and income, although returns were softer this quarter. With policy rates now close to cyclical lows in many economies, bond performance has become increasingly sensitive to movements in longer-term interest rates and fiscal concerns, but coupon rates are starting to improve.

Global equities: gains broaden beyond big tech

US equities remained a key driver of global market performance, although gains were more modest than earlier in 2025. Importantly, market leadership continued to broaden. Returns were no longer dominated by a small group of large technology companies. A wider range of sectors and regions contributed to overall performance. This is a healthy development. It reduces reliance on a handful of stocks and creates a broader opportunity set for investors.

Other global markets also delivered encouraging results. European and UK equities posted solid gains, while parts of Asia, including Japan and China, performed well at different points during the quarter.

Global equity market performance since start of 2025, local currencies (index = 100 on 1 Jan 2025)

Source: Refinitiv, Forsyth Barr analysis

The US corporate earnings season is now well underway, and results to date have been supportive. Many companies have reported solid profit growth and stable margins, reinforcing confidence in underlying business conditions. While enthusiasm around AI investment remains high, investors have become more selective. They are increasingly rewarding companies that can clearly demonstrate earnings delivery rather than relying solely on long-term growth narratives.

US macro backdrop remains supportive, despite political noise

In the US, share markets continued to rise, albeit at a more measured pace. Some areas of the market that appeared stretched late last year have seen more cautious investor behaviour, particularly in parts of the AI and technology sectors. This shift towards greater valuation discipline is a constructive sign. It may create opportunities where concerns have become overdone.

On the macroeconomic front, the US Federal Reserve held interest rates steady at its first meeting of 2026, following rate cuts late last year. Economic data point to a slowing but still resilient US economy, with inflation easing gradually and the labour market showing signs of stabilisation.

Political developments have also been in focus, with former Federal Reserve Governor Kevin Warsh nominated to succeed Jerome Powell as Fed Chair, subject to Senate approval. While political pressure around interest rates has increased, the Federal Reserve’s committee-based decision-making process helps provide continuity and stability in monetary policy.

Australian markets mixed as interest rates look set to rise

Australian equities delivered mixed, but generally positive, results over the quarter, with the ASX 200 rising +0.4%. While gains were modest at the index level, individual stock performance was more dynamic, with rising commodity prices and shifting expectations around interest rates driving returns. Growing caution towards global technology companies also weighed on Australian tech stocks, as investors refocused on company fundamentals and current earnings rather than future growth prospects.

While gains were modest at the index level, individual stock performance was more dynamic, with rising commodity prices and shifting expectations around interest rates driving returns. Growing caution towards global technology companies also weighed on Australian tech stocks, as investors refocused on company fundamentals and current earnings rather than future growth prospects.

In early February, the Reserve Bank of Australia (RBA) delivered a +25bp interest rate hike, taking the cash rate to 3.85%. Stronger inflation and labour market data drove the move in the cash rate, with another rate hike likely in coming months.

NZ economy in recovery mode

The RBA has been one of the first central banks in the developed world to begin lifting interest rates again in this economic cycle (with Japan a notable exception). Closer to home, there is a growing expectation that the Reserve Bank of New Zealand (RBNZ) may not be too far behind, with interest rate increases potentially back on the agenda later this year.

At the end of last year, the RBNZ cut the Official Cash Rate (OCR) by a further -25bp in November, taking it to 2.25%. Barring any major economic shocks, this is widely expected to mark the final rate cut of the current cycle. After several challenging years, the NZ economy shifted into recovery mode in the second half of 2025. There are increasing signs this momentum will carry through into 2026. Economic activity is picking up across a range of regions and sectors. Business and consumer confidence have improved, retail spending is gaining traction, and the labour market is beginning to stabilise.

If this recovery proves durable, the next move in interest rates is likely to be upwards, with increases potentially starting later in 2026.

Central bank policy rates and market expectations (!)

Source: Refinitiv, Bloomberg, Forsyth Barr analysis

NZ firms show improving momentum

NZ’s November reporting season provided further evidence that a cyclical recovery is taking hold. Company updates across several domestically focused sectors pointed to improving trading conditions. While the headline NZX 50 index has declined in the past three months, cyclical and consumer-related companies within the index have delivered relatively stronger returns.

NZ equities continue to appeal for their defensive characteristics, particularly high-quality, dividend-paying companies. With interest rates still low, yield-oriented sectors such as infrastructure and property continue to offer relatively attractive income streams, in some cases with the potential for steady dividend growth.

Some things never change

Markets will continue to evolve. 2026 will no doubt bring its share of surprises—both positive and negative. As we progress through 2026, the core principles of investing remain as relevant as ever:

- Volatility is a normal part of investing and can create opportunities—it is not, on its own, a reason to abandon a well-considered investment plan.

- Avoid letting fear or greed drive decisions. These emotions can push investors to sell after markets have already fallen, or to chase returns when prices are high—both of which can hurt long-term results. What matters most are your own investment objectives, personal circumstances, and time horizon; not market noise or someone else’s behaviour.

- Be wary of FOMO (fear of missing out) and of placing too much weight on recent performance, which can distort decision-making around market turning points.

We hope you enjoyed a restful holiday period and wish you all the best for the year ahead.

Matt Henry

Head of Wealth Management Research

Zoe Wallis

Investment Strategist

Not personalised financial advice: The recommendations and opinions in this publication do not take into account your personal financial situation or investment goals. The financial products referred to in this publication may not be suitable for you. If you wish to receive personalised financial advice, please contact your Forsyth Barr Investment Adviser. The value of financial products may go up and down and investors may not get back the full (or any) amount invested. Past performance is not necessarily indicative of future performance.

Disclosure: Forsyth Barr Limited and its related companies (and their respective directors, officers, agents and employees) (“Forsyth Barr”) may have long or short positions or otherwise have interests in the financial products referred to in this publication, and may be directors or officers of, and/or provide (or be intending to provide) investment banking or other services to, the issuer of those financial products (and may receive fees for so acting). Forsyth Barr is not a registered bank within the meaning of the Reserve Bank of New Zealand Act 1989. Forsyth Barr may buy or sell financial products as principal or agent, and in doing so may undertake transactions that are not consistent with any recommendations contained in this publication. Forsyth Barr confirms no inducement has been accepted from the researched entity, whether pecuniary or otherwise, in connection with making any recommendation contained in this publication.

Analyst Disclosure Statement: In preparing this publication the analyst(s) may or may not have a threshold interest in the financial products referred to in this publication. For these purposes a threshold interest is defined as being a holder of more than $50,000 in value or 1% of the financial products on issue, whichever is the lesser. In preparing this publication, non-financial assistance (for example, access to staff or information) may have been provided by the entity being researched.

Disclaimer: This publication has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. However, that information has not been independently verified or investigated by Forsyth Barr. Forsyth Barr does not make any representation or warranty (express or implied) that the information in this publication is accurate or complete, and, to the maximum extent permitted by law, excludes and disclaims any liability (including in negligence) for any loss which may be incurred by any person acting or relying upon any information, analysis, opinion or recommendation in this publication. Forsyth Barr does not undertake to keep current this publication; any opinions or recommendations may change without notice. Any analyses or valuations will typically be based on numerous assumptions; different assumptions may yield materially different results. Nothing in this publication should be construed as a solicitation to buy or sell any financial product, or to engage in or refrain from doing so, or to engage in any other transaction. Other Forsyth Barr business units may hold views different from those in this publication; any such views will generally not be brought to your attention. This publication is not intended to be distributed or made available to any person in any jurisdiction where doing so would constitute a breach of any applicable laws or regulations or would subject Forsyth Barr to any registration or licensing requirement within such jurisdiction.

Terms of use: Copyright Forsyth Barr Limited. You may not redistribute, copy, revise, amend, create a derivative work from, extract data from, or otherwise commercially exploit this publication in any way. By accessing this publication via an electronic platform, you agree that the platform provider may provide Forsyth Barr with information on your readership of the publications available through that platform.