Winners and losers from reporting season

Published March 2024

Author:

The February reporting season seems to arrive faster every year and the reporting calendar seems to get more and more condensed. (Note to IR departments reading this, having 7 earnings results on the same day does reduce the quality of investor engagement).

This year’s iteration was no exception and has arguably been one of the most eventful reporting seasons in a while, largely due to a weak economic backdrop. We have seen a higher than normal number of earnings confessions, some high-profile misses and a couple of earnings beats that have pleasantly surprised to the upside. With a busy earnings season behind us it feels right to make use of the timeliness of this column to look through some of the winners and losers of this earnings season as well as some of the odd quirks that the team have debated throughout February.

Winners and Losers

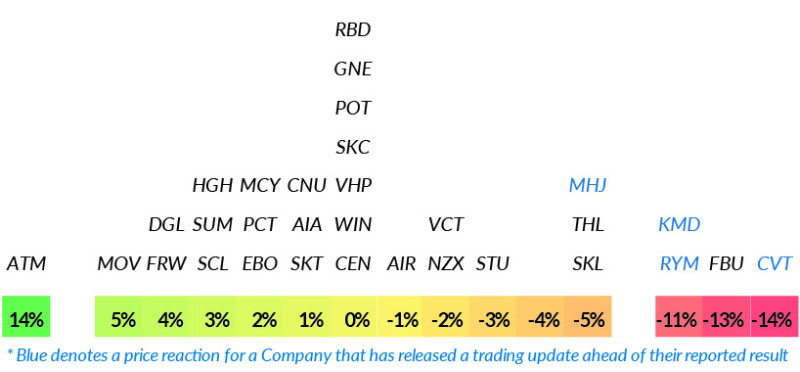

It only takes a quick look at the chart below to see that there are some stand out names on either end of the spectrum when it comes to “on the day of reporting” share price reactions. A2 Milk (ATM) may be operating in a structurally declining Chinese infant formula market but it is performing well with a strong product portfolio winning them market share. Whilst A2’s share price is down 70% from its July 2020 peak, the rebasing of earnings suggests the market is more comfortable with its current valuation in light of risks ahead. Historically ATM has seen an average +/-8% price reaction on day of reporting. Its +14% on the day price reaction for its latest result exceeded expectations and contributes to its +35% year-to-date gain.

Perhaps unsurprisingly, in a reporting season in the midst of a macroeconomic downturn, the other end of the spectrum is a little more crowded. Fletcher Building (FBU) takes out the wooden spoon for being the biggest loser, off -13% on the day of its 1H24 results thanks to a material miss to EBIT largely driven by a deterioration in residential volumes and margin impacts.

Fletcher is not alone however, and is joined by Ryman Healthcare (RYM), Comvita (CVT), and Kathmandu (KMD) who were prime examples of why late January and early February are called ‘confession season’ and all came out with downgrades ahead of their reported results. Their “on the downgrade day” share price reaction has been included in the below chart for completeness.

Two peas in a pod

If I asked you to tell me two listed companies that are alike, I highly doubt that A2 Milk and Sky TV (SKT) would even be in your top five picks. Curiously though, there is a striking similarity in these two businesses that sits at the core of both of their operations, though you wouldn’t guess it from their 12 month forward P/E multiples.

A2 Milk is currently sitting at 24x forward P/E versus Sky’s 7x. Sky’s multiple reflects the risk of renewal (or not) from the five year NZ rugby rights contract which creates a continual cycle of earnings uncertainty. While A2 does not have to worry about how much they might pay up for the All Blacks, they do have their very own five year rights renewal risk with their Chinese State Administration for Market Regulation (SAMR) licence and highly co-dependent relationship with producer Synlait. One could argue that A2’s earning are far more exposed to this five-year renewal risk than Sky as Sky is more advanced in building out a product portfolio that diversifies the company away from paying whatever sum NZ Rugby and its new (heavily commercially incentivised) partner demands.

Right now, A2 has nowhere else to put their China label infant formula production, something the company is keenly aware of as it looks to shore up its supply chain capabilities. Two structurally declining markets, two rights renewal cycles and two very different multiples applied by the market; at least gives you pause for thought.

Value is in the eye of the NBIO holder (Non-binding indicative offer)

The New Zealand market has seen its fair share of corporate action in the last few months with bids being lobbed at the likes of Rakon, Sky TV, Arvida and now Comvita. Having downgraded earnings guidance and outlook on the first of the month, Comvita’s market cap fell to ~$125m ahead of the NBIO, supported by its $145m inventory value, without any consideration given to the value of its Manuka forests or extraction plants. This makes it an undoubtedly attractive target to both industry players and private equity. Comvita is no stranger to a bid, in fact Comvita has been subject to bids, some more credible than others, in 2011, 2018, a rumoured approach in 2022 and again in February 2024. For those with a shorter memory the 2011 bid by Cerebos Pacific is particularly notable. After offering $2.50 for the company Cerebos walked away, refusing to increase its offer on the back of an independent valuation range of $3.40 to $4.00. Six months later Comvita printed a full year profit of $8.2m on $95.9m of sales. While there is no news confirming a bid price for the company in the current version, it is said by Comvita to be at a significant premium to the pre-bid share price of around $1.79. For reference, thirteen years after the Cerebos approach, Comvita’s most recent full year result saw the company print a $13.1m profit on $234m of sales.

Friends aren't forever, but the ComCom is

Air New Zealand and Auckland Airport; you really can’t have one without the other but that doesn’t mean that it’s all love and roses when it comes to this symbiotic relationship.

Earlier in the month Air NZ lodged an official request with the Commerce Minister seeking an urgent inquiry into the regulation that is failing to constrain “overspending” by Auckland Airport, who is proposing a $7 billion to $8 billion development pipeline over the next decade. The airline has said that the redevelopment costs will make flying unaffordable for some Kiwis. The average Kiwi might say that’s a bit rich coming from Air New Zealand, whose 86% share of the domestic travel market has seen them aggressively hike prices post-pandemic. Despite its sometimes unpalatable airfares, Air NZ’s full year guidance outlined at its result implies earnings before tax in the second half to be -$5m to $35m which puts Air NZ on a 12 month forward PE of 20x versus the long-term average of the sector of 9-10x. Earnings in the airline sector are cyclical, but both companies valuations depend on an affordable experience for customers.

With a handful of companies still yet to report at time of writing I have called it slightly early, but the Margin Call deadline waits for no company, and with over fifty percent of the NZ50 by index weight having reported, I have think we have seen more than enough to keep us busy for the meantime.

Paige Hennessy is an Equity Analyst at Octagon Asset Management.

Disclaimer: This article has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. This article does not contain financial advice. Octagon Asset Management is the investment manager for Octagon Investment Funds and the Summer KiwiSaver scheme. Some of the Octagon portfolios own securities issued by companies mentioned in this article.

This is supplied content and not commissioned or paid for by NBR.

Related reading

CSL and Fisher & Paykel Healthcare (FPH) were working their…

At first glance, the recent surge in Briscoes’ share price might imply a significant earnings beat, takeover speculation, or p…

The last two or three years have seen the Official Cash Rate (OCR), and other short-term interest rates, touch heights not seen since before the …

Fittingly for an industry bu…

The past couple of years have been challenging for domestic bond investors. The Bloomberg N…

The core concept of Environmental, Social, and Governance (ESG) has existed for centuries, dating back to religious codes banning investments in slave labour, through to div…

It is no secret that us New Zealanders love to invest in property as a way of building wealth. …

Kiwi households have almost NZ$250 billion sitting in their bank accounts - that's more than double all of th…

For investors that hold assets denominated in a foreign currency, there is both a direct exposure to exchange rate risk, as well as the price risk of the a…

Octagon looks to enhance the returns for our customers by being an active manager in the markets we invest in. This means, by definition and sty…

Bonds are often seen as less glamorous, less volatile, and basically boring when compared with the high-octane, high-ris…

Diversification is the great free lunch in investing – a …

to streamline the post-election government formation process.

Waiting for Godot, by Irish playwright Samuel Beckett, is a tragicomedy in two act…

More than a half-century ago, in November 1971, the then Prime Minister of New Zealand Keith Holyoake flew to Invercarg…

Say we flip a coin. Heads or tails? Heads – you may carry on exactly as you are now. Tails – 77% of your revenue strea…

How profitable are New Zealand’s banks? Seems a fair question aft…

In a July 2022 article we covered the basics of New Zealand Government inflation-linked bonds; how the…

A paper by the International Monetary Fund titled ‘The Long-Run Behaviour of Commodity Prices:…

With its mild weather, beautiful beaches, bountiful natural resources, and economic performance, Australia is often described as the lucky country (…

The term ESG (Environmental, Social and Governance) was officially coined in a 2…

New Zealand net migration has been a hot topic of late. As our econo…

One of the simplest truisms in investing is that share prices follow profits – on average, over the long term. Perh…

A few years back I read a book by Daniel Kahneman, Thinking Fast and Slow. It coined a phrase that captures the way I think about volatil…

Inflation-linked bonds are another option for income investors.

Today, we’re going to discuss wha…

The effects of Covid continue to reverberate throughout New Zealand more than two years after…

Where we came from

The boom in New Zealand’s property market has been extremely…