Waiting for Winston; a tragicomedy brought to you by MMP

Published September 2023

Author:

ANALYSIS: Maybe there should be mechanisms introduced

to streamline the post-election government formation process.

Waiting for Godot, by Irish playwright Samuel Beckett, is a tragicomedy in two acts that sees the main protagonists engage in a variety of discussions and encounters while waiting for Godot, the unseen titular character of the play who is expected to change the characters’ mundane and miserable existence. Quite who or what Godot is, the audience never finds out. Are they ‘God’ or some other supernatural being? Are they death? Or are they something less spectacular and altogether more benign? The theme of the play is, of course, not about Godot, rather about the wretchedness of interminable waiting.

It feels like Mixed-Member Proportional Representation (MMP) has provided several Waiting for Godot moments since its introduction in 1996, as a multitude of political parties compete to form a stable government. However this tragicomedy, played out in the media over many weeks has often felt more like ‘Waiting for Winston’ rather than Godot. And rather like our characters in the play, the wait can be quite wretched for equity investors.

Democratic elections are undeniably a cornerstone of a modern society, providing citizens with the power to choose their representatives and shape the political and policy direction of their nation. Open elections and the peaceful transition of power should be immutable; thankfully New Zealand has yet to encounter a challenge to our political and cultural norms like those the world saw in Washington DC on January 6, 2021.

However, since the introduction of MMP, we have seen a longer and more extended period of negotiations in forming a government. New Zealand moved to the MMP electoral system because the electorate felt the previous First Past the Post (FPP) system delivered stable majority governments, but elected by only a minority of the voting population, with little check on executive power. This high-minded intent seems at odds to our more recent experiences, with governments being decided by minority parties with one or two electoral seats or just over 5% of the popular vote.

The introduction of MMP governments has undoubtedly introduced a degree of uncertainty into post-election politics and the time it takes to form a stable government. This delay can significantly affect short-term economic stability and, as we saw in the aftermath of the 2017 election, that instability can also lead to a more obstinate, long-term deterioration in business confidence.

Investors like certainty and stability and the New Zealand experience of MMP elections shows they infrequently deliver results on the night. MMP has more often delivered policy uncertainty, as the horse trading around the focus of the next government’s policy – what’s in and what’s out – has made it difficult for investors to predict the future regulatory and economic environment.

Source: UBS

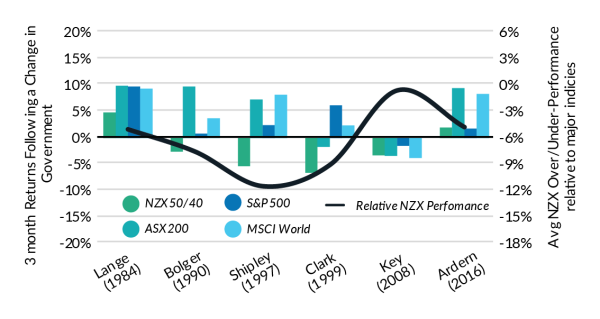

NZX performance in reaction to election results

As you can see in the above graph, on just two occasions in the 90 days after a change of government has the NZX50 returned a positive number (Lange 1984 and Ardern 2017) but, on every occasion since 1984 when there has been a change of government, the NZX50 has underperformed relative to major global indices. This has included both FPP and MMP elections, albeit the two periods with the worst relative underperformances for the NZX50 were both in the MMP period (Shipley 1997 and Clark 1999).

The closest the NZX50 has come to matching relative performance against the major global indices was the change to the Key government of 2008, when the global financial crisis was near its zenith. Even then, with a New Zealand economy not greatly linked to the carnage happening in equity markets and the financial sector, the NZX50 could only modestly beat the MSCI World and ASX200 indices but still performed worse than the S&P500, the widely followed US equity index at the centre of the financial storm.

The impact of election-induced uncertainty isn’t limited just to investment markets; it permeates the broader economy. Consumer and business confidence can wane as citizens await election results and assess the potential consequences for their own back pocket. Until the government’s stance on crucial issues becomes clear, it is only natural for consumers and companies alike to hold off on investments.

As we saw in 2017, this deterioration in sentiment isn’t just limited to the days and weeks after the election but can sometimes drag on for months. Businesses, both domestic and international, might hold off on making strategic decisions until they can ascertain the government’s economic and policy agenda.

Under the current MMP electoral system, coalition building and negotiations often take time. The longer it takes to establish a stable government, the greater the economic uncertainty and risk of prolonged post-election instability. But does this need to last?

The malaise the economy found itself in after the 2017 election, the first time of voting under MMP that the party securing the highest proportion of the popular vote did not form the government, was it really justified?

Recent research from Forsyth Barr suggests that, beyond the first 90 days of equity market underperformance, over the term of a three-year parliament, it really makes no difference as to who is sitting on the Treasury benches when it comes to equity markets.

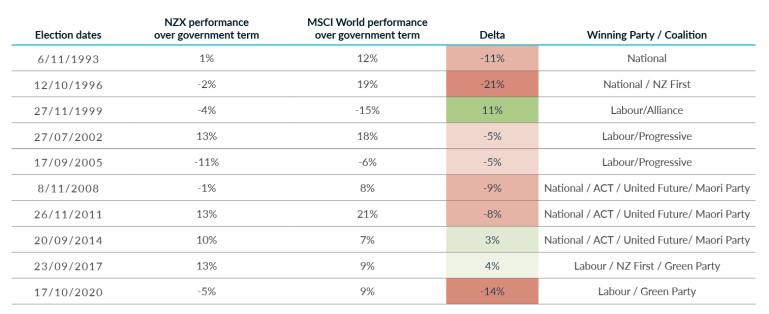

From the table below, you can see that, more often than not over the past 30 years (10 parliaments), the NZX50 has underperformed the MSCI World index for the term of the parliament and that the ideology of political party forming the government is no guarantee of equity market performance.

The worst relative performance for the NZX50 versus the MSCI World index came with a National-led government and the best relative performance was when a Labour-led government sat on the Treasury benches.

What does this mean?

Should this be a surprise to an equity investor? Not really. Governments and ministers change relatively frequently, far more frequently than the long-term strategic plan does for a successful company. Companies need to adapt to both government policy and market forces and to be resilient during periods of uncertainty. For an investor, the true measures of success will be a company’s ability to generate cashflow and invest it wisely for future growth or efficiently returning it to shareholders. These factors will determine the success of a company, in spite of, rather than because of, who is in government.

So, while democratic elections are a fundamental aspect of any healthy political economy and not without their challenges for businesses and investors, the uncertainty generated by elections should not affect long-term strategies. Elections can have ripple effects that reach beyond the ballot box and we see this more under the MMP electoral system than before, due to the uncertainty of policy negotiations to form a stable government.

There have been discussions about a four-year parliamentary term to allow government more time to implement policy, but maybe there should also be a discussion about finding mechanisms to streamline the post-election government formation process? Elections should reflect the will of the population but also be about continuity and stable government.

In Waiting for Godot, Act I opens with the two protagonists lamenting their most recent troubles; one of the characters even revealing to the audience how he spent the previous night lying in a ditch and receiving a beating from a number of anonymous assailants.

Which Chris will (metaphorically of course!) be lying in a ditch and lamenting the beating they received at the hands of the electorate come 14 October? Who knows? But, for the sake of economic certainty and overall stability, let’s hope the election is decisive and we can avoid the third act of ‘Waiting for Winston’ and can quickly get on with making the changes this country needs.

Disclaimer: This article has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. This article does not contain financial advice. This article was supplied to NBR and first published 26 September 2023.

Related reading

CSL and Fisher & Paykel Healthcare (FPH) were working their…

At first glance, the recent surge in Briscoes’ share price might imply a significant earnings beat, takeover speculation, or p…

The last two or three years have seen the Official Cash Rate (OCR), and other short-term interest rates, touch heights not seen since before the …

Fittingly for an industry bu…

The past couple of years have been challenging for domestic bond investors. The Bloomberg N…

The core concept of Environmental, Social, and Governance (ESG) has existed for centuries, dating back to religious codes banning investments in slave labour, through to div…

It is no secret that us New Zealanders love to invest in property as a way of building wealth. …

Kiwi households have almost NZ$250 billion sitting in their bank accounts - that's more than double all of th…

For investors that hold assets denominated in a foreign currency, there is both a direct exposure to exchange rate risk, as well as the price risk of the a…

Octagon looks to enhance the returns for our customers by being an active manager in the markets we invest in. This means, by definition and sty…

Bonds are often seen as less glamorous, less volatile, and basically boring when compared with the high-octane, high-ris…

Diversification is the great free lunch in investing – a …

More than a half-century ago, in November 1971, the then Prime Minister of New Zealand Keith Holyoake flew to Invercarg…

Say we flip a coin. Heads or tails? Heads – you may carry on exactly as you are now. Tails – 77% of your revenue strea…

How profitable are New Zealand’s banks? Seems a fair question aft…

In a July 2022 article we covered the basics of New Zealand Government inflation-linked bonds; how the…

A paper by the International Monetary Fund titled ‘The Long-Run Behaviour of Commodity Prices:…

With its mild weather, beautiful beaches, bountiful natural resources, and economic performance, Australia is often described as the lucky country (…

The term ESG (Environmental, Social and Governance) was officially coined in a 2…

New Zealand net migration has been a hot topic of late. As our econo…

One of the simplest truisms in investing is that share prices follow profits – on average, over the long term. Perh…

A few years back I read a book by Daniel Kahneman, Thinking Fast and Slow. It coined a phrase that captures the way I think about volatil…

Inflation-linked bonds are another option for income investors.

Today, we’re going to discuss wha…

The effects of Covid continue to reverberate throughout New Zealand more than two years after…

Where we came from

The boom in New Zealand’s property market has been extremely…