US Equities - simply momentum or something more fundamental

Published June 2024

Author:

The momentum run in the US market continues to be very strong. It resembles in many ways the peak rally in 1999 to early 2000, just before the “dot com” crash. Like that historic era, earnings growth in the tech sector today is outpacing the growth of the rest of the US economy. As I review the trading screens of the S&P500 index last week they were screening expensive, at the extreme end of the two standard deviation range. In a chartist’s world, it is a signal to sell and reduce exposure to the over-priced assets.

But hold on; are we seeing the same risk of a bubble bursting in 2024 like the one that did so dramatically during the dot com crash of the early 2000’s? Could history repeat, or is it different this time?

But this time it's different. Again?

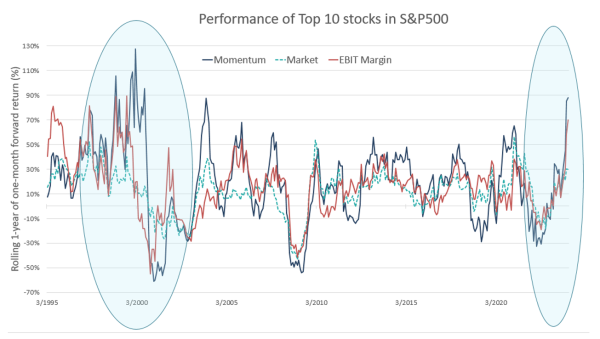

Is the market that much different today when compared to the late 1990s? Today share prices are being driven by the quality and scale of the earnings and revenues of the large cap stocks. Unlike the late 1990s, when profitable stocks were underperforming momentum stocks until just before the downturn of the market, today the profitable stocks are correlating closely with momentum, and that is consistent with their long-run relationships (correlation 0.62).

Source: Bloomberg, Standard & Poors, analysis by Octagon Asset Management

I built a quant measure to evaluate what I term as the “momentum effectiveness” of the top ten stocks in the S&P500. The momentum factor, in an academic sense, is the long-short portfolio of stocks that exhibit and maintain the strongest price action. It is not a factor study I am after, rather the behaviours of the large cap concentrated stocks.

The “price actions” of these large cap stocks can partially be explained by the earnings upgrades from those companies exposed to artificial intelligence. The most recent March quarter earnings beat market expectations for Alphabet, Amazon, Apple, Meta Platforms, Microsoft whilst Tesla missed. NVidia is still to be announced (as at date of writing).

Collectively as a group, their revenue growth is spectacular. Sales growth has accelerated not just year over year but also sequentially over several quarters. The scale and speed of revenue growth has generated exceptional operating leverage and positive earnings momentum is seeing more than a two-fold increase in profit-margins over sales.

It's raining cash in the Valley (and Seattle)

The primary difference between the 2024 cohort of market leading, large cap momentum stocks and their dot com predecessors is their free cash flow generation. They have roughly doubled their free cash flow margins since 2012 and have much lower capital expenditures as a share of cash flows than the 1999-2000 cohort.

In the past, growth stories required a cash flow trade-off, where an investor had to sacrifice current profitability for the promise of future, supernormal cash-flows. But not today. Apple has so much cash sitting on its balance sheet that it is turning into a bank, offering consumers’ interest-free 0% loans to finance the purchase of Apple products. Apple also gives the mainstream banks a run for their money with an interest rate of 4.5% on clients’ savings accounts. As a group, their free cash flow margins are twice the S&P 500 market average. Apart from Amazon and Tesla, this group is making $0.20 of free cash flow off $1.00 of sales. Cisco was not doing that in March 2000.

Also, these tech giants also have a very strong market position in their own fields. Apple is a leader in smartphones, Google is dominant in search engines, and NVidia is far and away the outright leader in AI-specific semiconductor design and fabrication. Others gain operating synergies through strong network effects that create significant economic moats. Amazon used their E-commerce platform to attract customers to buy books, but now they buy media (that requires cloud storage) and other general retail. Amazon looks to attract more customers and attempts to lock them in with the sheer breadth of products they sell.

Furthermore, they benefit from large economies of scale by efficiently driving down their cost structure while maintaining pricing power over their products. We saw a graphic the other day where the Magnificent 7 have made over 800 acquisitions between them to gain and maintain market power, effectively extinguishing any threats from would-be competitors not just today but well into the future.

This group of momentum leaders also differentiate against the late 1990s and early 2000s cohort in that they are generally well past their start-up phase and have fortress-like balance sheets that they keep adding to. They, and the US market in general, have done a good job of terming out their debt, shielding them (for a while) from the recent large increase in interest rates.

Are we convinced about the downside risks? Of course we are.

Mean reversion of a strong momentum run is a common occurrence. Although momentum does not always cause stock market bubbles, it is usually part of the story. It often starts with some “big” new narrative that captures the imagination and propels the market ahead. Investors extrapolate the scale and the speed at which the big new narrative will turn to actual earnings. Dutch Tulips; South Sea Company shares; Japanese equities mid-1980’s or the Dot Com crash of the early 2000’s; history is littered with asset bubbles that have burst very quickly and painfully for investors.

So is the 2024 cohort different? Sell-side analysts are expecting the Magnificent 7 to deliver ~13% or more revenue growth per annum over the next five years. Couple this with ~17% or more earnings growth on average over the same five year period and ~22% or more free cash flow you might think there is no reckoning for massive large cap companies growing at an extraordinary clip generating unfathomable amounts of cash. But really, how reasonable are these growth projections?

Can these world’s biggest stocks keep growing at the same or even accelerating rates? Have the world’s competitive dynamics changed? Is this the new normal, a paradigm shift to use the language of the early 2000s? Will NVidia always have the best chips (in the early 2000s the semiconductor market darling was Intel)? Will Tesla always lead in the EV and Battery space? Will the regulators try and break up the perceived monopolies that Alphabet (Google) has over search and Meta has in social media and digital advertising?

Like beauty, valuation is in the eye of the beholder

When looking at the numbers, valuations for the US equities asset class looks stretched. But you do not have to believe in the rocket ship growth numbers that propelled the 2000’s.

The dividend discount model is a common valuation method used to price stocks. ERP (Empirical Research Partners) have implemented the model, using multiple different scenarios, to review the valuation of today’s cohort. Unlike the 2000’s, when revenues and multiple expansion drove share price growth, the dividend discount model uses today’s and future years’ dividend cash flows to investors to calculate the fair value of a stock.

It seems that even mega-cap tech growth stocks have a habit of changing their (valuation) spots over time.

The assumptions ERP use appear reasonable, building on recent trends around profit margins and cash flows, but even they acknowledge that trees don’t grow to the sky. On their analysis, the stocks are fully priced but far from the manic levels we saw in the dot com crash. The model is sensitive to assumption changes, such as sudden drop in free cash flow generation, or a sustained rise in real interest rates, but then, the future is anybody’s guess.

The author would like to credit three excellent research reports from Empirical Research Partners for highlighting some of these ideas and providing the valuation frameworks.

Michael L Goldstein et al., Stock Selection: Research and Results, (March 2024)

Michael L Goldstein et al., Portfolio Strategy, (April 2024)

Rochester Cahan et al. Portfolio Strategy, (February 2024)

Christine Smith-Han is Strategy Analyst at Octagon

Disclaimer: This article has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. This article does not contain financial advice. Some of the Octagon portfolios own securities issued by companies mentioned in this article. Octagon Asset Management is the investment manager for Octagon Investment Funds and the Summer KiwiSaver scheme.

Related reading

CSL and Fisher & Paykel Healthcare (FPH) were working their…

At first glance, the recent surge in Briscoes’ share price might imply a significant earnings beat, takeover speculation, or p…

The last two or three years have seen the Official Cash Rate (OCR), and other short-term interest rates, touch heights not seen since before the …

Fittingly for an industry bu…

The past couple of years have been challenging for domestic bond investors. The Bloomberg N…

The core concept of Environmental, Social, and Governance (ESG) has existed for centuries, dating back to religious codes banning investments in slave labour, through to div…

It is no secret that us New Zealanders love to invest in property as a way of building wealth. …

Kiwi households have almost NZ$250 billion sitting in their bank accounts - that's more than double all of th…

For investors that hold assets denominated in a foreign currency, there is both a direct exposure to exchange rate risk, as well as the price risk of the a…

Octagon looks to enhance the returns for our customers by being an active manager in the markets we invest in. This means, by definition and sty…

Bonds are often seen as less glamorous, less volatile, and basically boring when compared with the high-octane, high-ris…

Diversification is the great free lunch in investing – a …

to streamline the post-election government formation process.

Waiting for Godot, by Irish playwright Samuel Beckett, is a tragicomedy in two act…

More than a half-century ago, in November 1971, the then Prime Minister of New Zealand Keith Holyoake flew to Invercarg…

Say we flip a coin. Heads or tails? Heads – you may carry on exactly as you are now. Tails – 77% of your revenue strea…

How profitable are New Zealand’s banks? Seems a fair question aft…

In a July 2022 article we covered the basics of New Zealand Government inflation-linked bonds; how the…

A paper by the International Monetary Fund titled ‘The Long-Run Behaviour of Commodity Prices:…

With its mild weather, beautiful beaches, bountiful natural resources, and economic performance, Australia is often described as the lucky country (…

The term ESG (Environmental, Social and Governance) was officially coined in a 2…

New Zealand net migration has been a hot topic of late. As our econo…

One of the simplest truisms in investing is that share prices follow profits – on average, over the long term. Perh…

A few years back I read a book by Daniel Kahneman, Thinking Fast and Slow. It coined a phrase that captures the way I think about volatil…

Inflation-linked bonds are another option for income investors.

Today, we’re going to discuss wha…

The effects of Covid continue to reverberate throughout New Zealand more than two years after…

Where we came from

The boom in New Zealand’s property market has been extremely…