Tale of Two Healthcare Heavyweights

Published February 2026

Author:

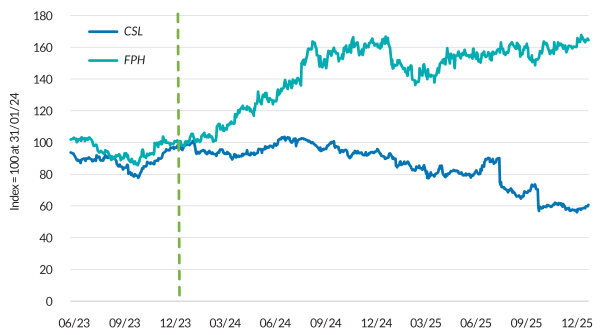

Rewind the clock two years, and the battle between the two healthcare giants in the Australian & New Zealand indices looked very different.

CSL and Fisher & Paykel Healthcare (FPH) were working their way through COVID disruptions and, in the case of CSL, integrating a large acquisition. Supply and demand dynamics were normalizing, markets had recalibrated earnings expectations, and the two companies’ were broadly moving in a similar direction.

Fast forward to today, and the picture has changed dramatically. CSL’s market capitalisation has almost halved since then, while FPH has ripped over 60%.

So, what has caused the stark divergence?

Figure 1: Market capitalisations of CSL & FPH indexed to 100 at 31/01/2024

Source: Octagon research

Concepts of a Healthcare Plan

The arrival of the current US administration last year was marked by the arrival of universal uncertainty. Healthcare — and pharmaceutical companies in particular — were no exception, and quickly found themselves in the firing line.

This was driven in part by a broad, often indiscriminate and ever changing application of tariffs, initially through blanket measures and later via tariffs embedded within negotiated trade deals, as well as the use of Section 232 investigations to advance an “America First” agenda.

Alongside this, senior officials signalled an intent to pursue drug pricing reform, most notably through the proposed “most-favoured nation” policy. While some of the rhetoric — promises to bring drug prices “down 400%, 200%, 600%, numbers that nobody’s ever seen before” — was mathematically impossible, the message was clear: the US intended to pay materially less for pharmaceuticals.

The three key policy areas impacting CSL and FPH the most are:

1. Tariffs: charges placed on imports into the US.

2. Most Favoured Nation (MFN): aligning US drug prices with those in comparable countries. Historically, the US has paid materially higher prices.

3. Section 232: investigations into pharmaceutical products and medical devices.

Much like most things coming out of Washington recently, detail is scarce and certainty even scarcer. What is clear, however, is that the distribution of risk is asymmetric, and arguably CSL faces a wider range of outcomes.

The company does have mitigating factors, including its US collection and manufacturing footprint, committed new investment, and previous exemptions.

Meanwhile, FPH is not immune. Current tariff impacts are known, and the possibility of further punitive measures remains on the horizon.

The Anti-Vaccination Movement

While the longer-term impacts of policy shifts remain unpredictable, what is observable in the data today is the effect of a post-COVID movement against vaccinations — amplified by rhetoric from the US Department of Health and the Health Secretary.

Despite a record 2024/25 flu season, CSL warned the market at its FY25 results that its vaccine business would decline again in FY26. That decline proved worse than expected, prompting a guidance downgrade at the October AGM just two months later. This ran counter to historical experience, where severe flu seasons typically lead to a rebound in vaccination uptake the following year.

More recent data from the US suggested an even worse start to the current flu season than last year. While cases appear to be easing, the risk of a second wave — as seen previously — remains.

Figure 2: Flu rates spiked aggressively to start the 2025/26 season but have since eased

Source: CDC FluView

But, in the case of schadenfreude, one person’s pain is another’s pleasure.

Higher flu and respiratory illness rates translate directly into increased demand for respiratory devices and masks — precisely where FPH operates. This effect can be seen in the data, with exports to the US in December up strongly. That said, the benefits are small and incremental: management has guided that flu variability is worth +/-NZ$25m, equivalent to roughly +/- 6% of the mid-point of net profit after tax guidance, or 0.1% of FPH’s current market capitalization.

The True Diagnosis

Policy shifts — or even the threat of them — affect all businesses. In the case of CSL and FPH, supply chains can be shifted, pricing adjusting, and capital reallocated over time to mitigate the impact.

Similarly, short-term volatility in flu seasons or vaccination rates does not define long-term outcomes. Ultimately, science, data, and execution tend to prevail. Vaccine uptake movements are more likely cyclical than structural.

Rather the most impactful factors can be boiled down to:

1. Execution

At CSL, come key missteps include:

· The ~US$12b Vifor acquisition, which diluted returns and complicated the narrative,

· withdrawal of formal gross margin targets from the Horizon 1 program at Behring (around two-thirds of group earnings), undermining confidence in margin recovery,

· Failed new products e.g. CSL112.

FPH, by contrast, has arguably delivered ahead of expectations following the post-COVID re-set.

2. Competition

FPH has built a genuine moat in its hospital division, with management consistently highlighting the absence of direct competitors. In homecare, major competitor Philips was hamstrung by product recalls and regulatory issues, allowing FPH to consolidate share in the masks space.

All the while CSL has faced fears on increasing competition, oversupply of plasma, potential disruption to the demand outlook.

3. Outlook & expectations

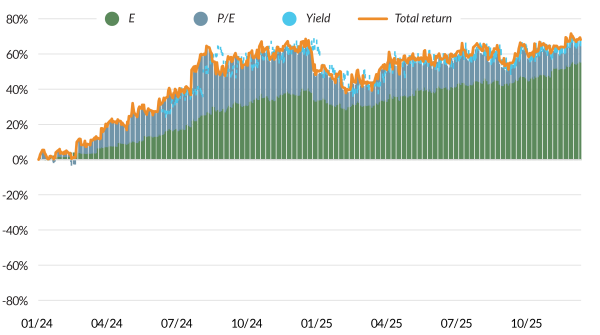

During COVID, the market extrapolated FPH’s super-normal earnings — and then, just as aggressively, extrapolated the decline once that demand surge unwound. Underlying demand proved far more robust than feared and adoption grew.

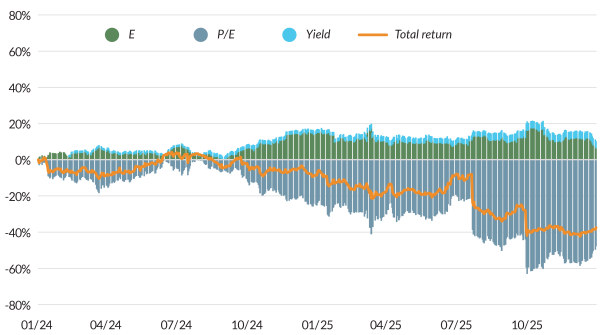

Meanwhile, CSL has had multiple downgrades, whether that be on the top-line or margin driven, which in combination with points 1 & 2, dented growth expectations.

All these factors have led to a reduction in the valuation multiple investors are willing to pay for CSL, compounded by the fact earnings have not grown as much as FPH.

Figure 3: A breakdown total returns show FPH forward earnings expectations have grown while the valuation multiple has expanded, while investors are willing to pay ~45% less for CSL

Source: Octagon research

Implications for the Investment Case

FPH has quietly and consistently grown revenues and earnings through expanding clinical evidence, deep physician relationships, disciplined investment and steady execution. Expectations have been exceeded.

CSL, by contrast, has faced operational missteps, intensifying competition and repeated earnings downgrades, with forward growth expectations reset multiple times.

So what does this mean for the investment case?

Over the long term, the performance of both companies will be driven by demand, therapy adoption and the earnings growth that follows. For investors, the question is not which business is “better”, but whether the price paid today offers an adequate risk-adjusted return across a range of future outcomes.

One now trades on ~45× forward earnings, the other closer to ~17×. These valuations not only reflect the market’s changed expectations for future outcomes, but also the length of time required for those expectations to be realised — and how much margin for error investors are being offered.

For investors, this creates a familiar but uncomfortable trade-off. Paying up for certainty can deliver excellent outcomes when execution remains flawless, but leaves little room for surprise. Buying into disappointment requires patience and conviction, but can offer a more favourable balance of risk and reward if operational performance stabilises and incremental improvement emerges.

In that context, while FPH’s premium may prove justified, CSL’s discount increasingly embeds a pessimism that may already account for more than the business ultimately delivers. At current levels, the asymmetry in outcomes appears to have shifted — and with it, the relative appeal of the two opportunities.

Jonty Nattrass is an Equity Analyst at Octagon Asset Management.

This article has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. This article does not contain financial advice. Some of the Octagon portfolios may own securities issued by companies mentioned in this article.

Octagon Asset Management is the investment manager for Octagon Investment Funds and the Summer KiwiSaver scheme.

Disclaimer: This article has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. This article does not contain financial advice. This article was supplied to NBR and first published 31 October 2023.

Related reading

At first glance, the recent surge in Briscoes’ share price might imply a significant earnings beat, takeover speculation, or p…

The last two or three years have seen the Official Cash Rate (OCR), and other short-term interest rates, touch heights not seen since before the …

Fittingly for an industry bu…

The past couple of years have been challenging for domestic bond investors. The Bloomberg N…

The core concept of Environmental, Social, and Governance (ESG) has existed for centuries, dating back to religious codes banning investments in slave labour, through to div…

It is no secret that us New Zealanders love to invest in property as a way of building wealth. …

Kiwi households have almost NZ$250 billion sitting in their bank accounts - that's more than double all of th…

For investors that hold assets denominated in a foreign currency, there is both a direct exposure to exchange rate risk, as well as the price risk of the a…

Octagon looks to enhance the returns for our customers by being an active manager in the markets we invest in. This means, by definition and sty…

Bonds are often seen as less glamorous, less volatile, and basically boring when compared with the high-octane, high-ris…

Diversification is the great free lunch in investing – a …

to streamline the post-election government formation process.

Waiting for Godot, by Irish playwright Samuel Beckett, is a tragicomedy in two act…

More than a half-century ago, in November 1971, the then Prime Minister of New Zealand Keith Holyoake flew to Invercarg…

Say we flip a coin. Heads or tails? Heads – you may carry on exactly as you are now. Tails – 77% of your revenue strea…

How profitable are New Zealand’s banks? Seems a fair question aft…

In a July 2022 article we covered the basics of New Zealand Government inflation-linked bonds; how the…

A paper by the International Monetary Fund titled ‘The Long-Run Behaviour of Commodity Prices:…

With its mild weather, beautiful beaches, bountiful natural resources, and economic performance, Australia is often described as the lucky country (…

The term ESG (Environmental, Social and Governance) was officially coined in a 2…

New Zealand net migration has been a hot topic of late. As our econo…

One of the simplest truisms in investing is that share prices follow profits – on average, over the long term. Perh…

A few years back I read a book by Daniel Kahneman, Thinking Fast and Slow. It coined a phrase that captures the way I think about volatil…

Inflation-linked bonds are another option for income investors.

Today, we’re going to discuss wha…

The effects of Covid continue to reverberate throughout New Zealand more than two years after…

Where we came from

The boom in New Zealand’s property market has been extremely…