Squeezing juice from a drying cash rate

Published June 2025

Yes, rates are falling—but your returns don’t have to

The last two or three years have seen the Official Cash Rate (OCR), and other short-term interest rates, touch heights not seen since before the GFC.

After thirteen years of unusually low interest rates post-GFC, and the generational lows of the post-pandemic recovery period, the last couple of years have allowed cash depositors to celebrate. Finally, they have been able to earn relatively decent nominal returns on their savings.

In 2021 the average six-month term deposit (TD) rate in New Zealand reached a record low of 0.82% based on Reserve Bank of New Zealand (RBNZ) data that has tracked deposit rates for 60 years.

However, by early 2024 the TD Rate had reached a much more reasonable (in the eyes of a cash investor) 6.00%. A remarkably steep increase on the back of unprecedented moves by the RBNZ to control inflation and engineer a recession. This was not to last, however. With the OCR currently at 3.25% and, if the Overnight Index Swap pricing is to be believed, likely to drop further it now looks like a good time for savers and defensive investors to assess whether their cash is working hard enough, especially on a tax-adjusted basis.

How much day-to-day cash do you really need?

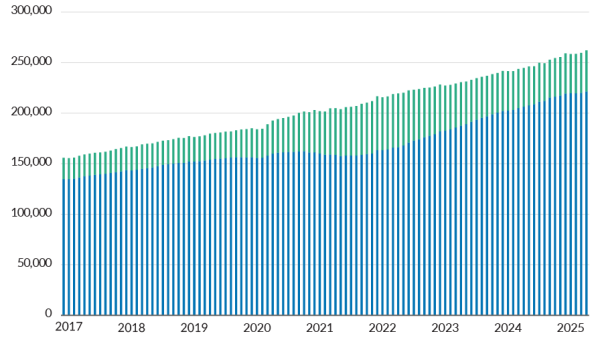

New Zealanders still love to hold their cash in the bank, maybe just a little too much. According to RBNZ published data [Banks: Liabilities – Deposits by sector – hs40’ as at April 2025] New Zealand households have around ~$262 billion across all forms of cash deposits of which ~$220 billion is sitting in term deposits and savings accounts. To give that figure some context, that’s almost twice the amount of funds invested in cash TDs and savings accounts than all of Kiwisaver.

Source: RBNZ. Banks: Liabilities – Deposits by sector (S40) - Reserve Bank of New Zealand - Te Pūtea Matua

The issue is that this money held in the bank may not be earning much, at all.

As of May 2025 the average savings account interest rate had fallen to between 0.74% and 2.66% (the higher end includes bonus interest for non-withdrawals). Term deposits shape up a bit better, with the average six-month term deposit rate 4.01%. However, term deposits are inflexible and if you change your mind and want your money back in hurry, you’ll very likely be penalised, a lot.

Thankfully there are other options for savers and defensive investors. Investing your savings into a cash fund can help your savings earn a risk and tax efficient margin above what you would in the bank, while maintaining the flexibility to withdraw your money as needed. These cash funds, often with names such as Enhanced Cash or Cash Plus, most usually offer investors better than transaction account rates without the liquidity lock-ups of term deposits.

Staying liquid and defensive

Cash funds will tend to invest your money in various short-term call accounts, deposits, commercial paper and short-dated fixed and floating-rate bonds. These assets might be issued by the New Zealand government, local councils, banks or other New Zealand corporates. A crucial aspect to most cash funds is that the manager will generally limit the fund’s sensitivity to interest rates (called ‘duration’ in finance industry jargon) to a very low level, this ensures that as wholesale interest rate jump around, investors will be largely insulated from that volatility.

The other key aspect to a cash fund’s portfolio construction is liquidity – the fund manager needs to ensure that they can meet client withdrawals even in times of market stress. Part of this is having plenty of investments that mature soon – the other part is holding assets that have an active secondary market i.e. can the manager easily sell an investment if they want or need to?

Generally, a cash fund will not offer you a fixed return, so your earnings will be a function of the performance of the assets the fund holds. A potential investor needs to consider whether the extra certainty provided by a bank compensates for the likely lower return.

Getting your slice of the PIE

Let’s not forget that almost all cash funds in New Zealand will be set-up as Portfolio Investment Entities (PIEs) which, depending on your marginal tax rate, may offer a significant tax benefit over holding cash in a standard bank account (which would be assessed for tax at your marginal tax rate). As the table demonstrates, there is substantial PIE tax benefit available for those cash investors on higher marginal tax rates.

|

Investor tax rate |

PIE fund rate |

Tax on non-PIE income* |

Tax via a PIE |

PIE benefit |

|

39% |

28% |

1.27% |

0.91% |

0.36% |

|

33% |

28% |

1.07% |

0.91% |

0.16% |

|

28% |

0.98% |

0.91% |

0.07% |

*Assumes 'non-PIE income' is 3.25%, the current OCR

While most of the discussion so far has been aimed at savers or defensive investors – cash funds can play an important role in any investor’s asset allocation.

Whether you’re a conservative, balanced or growth investor it’s common to have a portion of your funds permanently allocated to cash.

MJW’s March 2025 Kiwisaver survey found the average allocation to cash was 19%, 6% and 4% for Conservative, Balanced and Growth funds respectively. Cash can be used in this context to facilitate client flows, reduce overall volatility, and as ‘dry powder’ to be deployed into higher risk assets as the opportunity arises, as we saw in the post ‘Liberation Day’ equity market snap-back in early April.

With interest rates on bank accounts heading lower now’s a good opportunity to consider if your cash is working hard enough and how a return and tax efficient cash fund might fit into your saving and investing plans.

Disclaimer: This article has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. This article does not contain financial advice. Some of the Octagon portfolios own securities issued by companies mentioned in this article.

Related reading

CSL and Fisher & Paykel Healthcare (FPH) were working their…

At first glance, the recent surge in Briscoes’ share price might imply a significant earnings beat, takeover speculation, or p…

Fittingly for an industry bu…

The past couple of years have been challenging for domestic bond investors. The Bloomberg N…

The core concept of Environmental, Social, and Governance (ESG) has existed for centuries, dating back to religious codes banning investments in slave labour, through to div…

It is no secret that us New Zealanders love to invest in property as a way of building wealth. …

Kiwi households have almost NZ$250 billion sitting in their bank accounts - that's more than double all of th…

For investors that hold assets denominated in a foreign currency, there is both a direct exposure to exchange rate risk, as well as the price risk of the a…

Octagon looks to enhance the returns for our customers by being an active manager in the markets we invest in. This means, by definition and sty…

Bonds are often seen as less glamorous, less volatile, and basically boring when compared with the high-octane, high-ris…

Diversification is the great free lunch in investing – a …

to streamline the post-election government formation process.

Waiting for Godot, by Irish playwright Samuel Beckett, is a tragicomedy in two act…

More than a half-century ago, in November 1971, the then Prime Minister of New Zealand Keith Holyoake flew to Invercarg…

Say we flip a coin. Heads or tails? Heads – you may carry on exactly as you are now. Tails – 77% of your revenue strea…

How profitable are New Zealand’s banks? Seems a fair question aft…

In a July 2022 article we covered the basics of New Zealand Government inflation-linked bonds; how the…

A paper by the International Monetary Fund titled ‘The Long-Run Behaviour of Commodity Prices:…

With its mild weather, beautiful beaches, bountiful natural resources, and economic performance, Australia is often described as the lucky country (…

The term ESG (Environmental, Social and Governance) was officially coined in a 2…

New Zealand net migration has been a hot topic of late. As our econo…

One of the simplest truisms in investing is that share prices follow profits – on average, over the long term. Perh…

A few years back I read a book by Daniel Kahneman, Thinking Fast and Slow. It coined a phrase that captures the way I think about volatil…

Inflation-linked bonds are another option for income investors.

Today, we’re going to discuss wha…

The effects of Covid continue to reverberate throughout New Zealand more than two years after…

Where we came from

The boom in New Zealand’s property market has been extremely…