Should you care about Aged Care?

Published December 2025

Author:

It’s never easy to pick turning points for a particular company or the economy. But therein lies the opportunity. After a bruising few years, is now a good time to revisit the investment case for New Zealand’s listed aged-care operators?

We think the key drivers for the sector have improved dramatically in recent quarters and see several tailwinds, listed below (in no particular order).

· Sector gearing has peaked, with interest burdens set to fall and cash flow improving

· Ballooning operating costs are finally being addressed by management across the sector

· Disclosures have improved allowing greater visibility into possible financial outcomes for investors

· Operating margins in care appear to have bottomed out

· Development is moderating, with Capex expected to fall and competition to ease

· The NZ housing market has stabilised and on the back of recent OCR cuts is expected to rise

Whilst these fundamentals have all improved, valuations remain low and current price to net tangible assets (NTA) multiples are between -1.0 and -1.5 standard deviations below their 10-year trend. All names in the sector are trading well below independently assessed book values and balance sheet repair is underway. This scenario is quite rare and suggests scope for gains as the NZ housing market begins to improve.

How retirement villages actually make money

New Zealand’s listed cohort is down to three key names — Ryman Healthcare, Summerset and Oceania Healthcare — with Radius Healthcare a smaller, more care-heavy player. Their revenue engines can be powerful in combination, with new development and portfolio growth benefitting from large pools of interest free resident capital.

Key revenue streams include;

- Fees for Independent living (ORA units): residents pay weekly fees, and on exit, the operator earns a deferred management fee (DMF) calculated on the entry price.

- Care: weekly fees plus accommodation premiums.

- Resale/refinance margin: when a resident exits independent living, the operator resells the unit — typically at a higher price — crystallising a margin that has been a key driver of value creation and capital recycling.

- Income from Refundable Accommodation Deposits (RAD’s) – A form of interest free financing from residents, primarily used in Australia in-lieu of daily care charges

- Development margin: This is a component of operators non-GAAP ‘underlying profit’ measure which captures the profit generated through their development activities. When a newly built retirement unit is sold under an Occupational Right Agreement - ORA - any margin above the unit’s development cost is captured as a gain. Generally, development has added to an aged care company’s value over time.

For many years, a buoyant housing market pushed unit prices and average DMFs higher. From IPO to the 2021 peak, share prices and asset values compounded handsomely, Ryman, for a long time, was a market darling.

Why the fall from grace?

Aged-care equities have been punished for more than just softer housing market conditions.

The list of reasons that investors have decided to shun the sector is long and, at least partly, self-inflicted:

- Aggressive accounting choices and patchy disclosure that obscured cashflow quality

- Overzealous development during the boom, leading to inventory build-ups and increased competition

- Too much debt accumulation, too quickly

- Affordability squeeze as unit pricing outpaced falling house prices

- Scepticism around third-party asset valuations in a market where large assets seldom trade

- Cost inflation outpacing cash-based revenues

- Management turnover and governance questions

The result? Asset write-downs, restructurings, equity raisings and, for investors, a multi-year lesson in cyclicality.

Housing: what needs to change (and is starting to)

Turnover has been anaemic since late-2021. Elevated interest rates, softer employment confidence and a buyer-seller mismatch have kept inventory high and investors on the sidelines (rents down, holding costs up — the maths no longer works at today’s prices). For a genuine turn you need three things: lower mortgage rates, rising GDP and job growth.

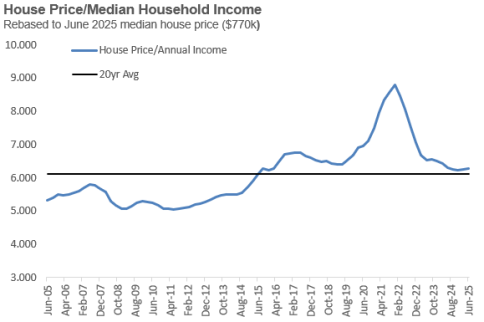

The good news: affordability has improved markedly and is back near 2015/16 levels on price-to-income metrics (chart below). We are closer to the point where lower rates translate into higher transaction volumes.

The recent downside surprise in quarterly GDP figures and a soft Q3 labour market statistic underscores slack in the economy. With limited fiscal room and structural reforms in education or energy offering little near-term growth, monetary policy will have to do more of the heavy lifting. When labour demand improves, net migration typically follows — and with it, housing demand and confidence.

The valuation setup: wide discounts, narrow expectations

While alternative (traditional) listed property assets in NZ are up 19% year-to-date, the aged-care sector has fallen sharply. Despite better trading commentary and a repaired balance sheet, Ryman still trades below its recent equity-raise price. Across the group, current prices imply minimal growth with shares at some of the widest discounts to independently assessed NTA in the sector’s listed history:

- Ryman ~0.69× NTA

- Summerset ~0.89× NTA

- Oceania ~0.54× NTA

In plain English: an average ~30% discount to book, for businesses with long-duration and powerful demographic tailwinds from our ageing cohort of asset rich baby boomers.

If public markets won’t close that gap, private capital may do so. The last two public to private takeovers in the space completed at ~0.83× NTA (Arvida, 2024) and (Metlifecare, 2020).

What’s changed inside the businesses

The sector has finally read the room. After investors demanded better disclosure, cashflow and capital discipline, operators have:

- Tightened up development activity, enabling built inventory to be absorbed

- Refocused on cash, pricing discipline and overhead control

- Improved disclosure, making it easier to track cash conversion, operating costs and balance-sheet risk

- Signs of better capital allocation, with dividend policies across the sector being reassessed to better reflect cash generation rather than accounting gains.

What to watch from here

- Interest rates & housing turnover: materially lower mortgage rates are the catalyst. Watch new listings, auction clearance, days-to-sell, and sales volumes as early signals.

- Sales volumes in new ORA contracts and settlements: Trends in contracted stock and settlements are key

- Progress in Australia: Operators have invested heavily in their Australian operations, proving out the returns from this investment is crucial

- Net migration: A useful tell for housing demand into 2026.

- Balance-sheet discipline: Lower net debt, gearing and more conservative development projects

Downside Risks

- Rates increase earlier than expected: Housing turnover fails to lift, delaying ORA settlements and pushing out the cashflow recovery.

- Competition: Development and unit deliveries are key drivers of pricing and inventory turnover – monitor landbanks to gauge future supply

- Affordability stalls: If incomes soften or unemployment overshoots expectations, house prices could resume their fall. Retirement village unit prices could follow.

- Cost inflation: Wage and operating cost growth exceeding price recovery

- Policy: Funding settings for care and ORA rules can and do change.

Bottom line

Aged-care equities were re-rated down for very good reasons and the sector destroyed a lot of investor sentiment built up over many years. Many of those reasons are now ‘in the price’ and then some. With housing affordability back to mid-2010s levels (compared to household income), monetary policy likely to ease further, and operator discipline improving, the sector offers clean leverage to a housing recovery.

You don’t need to believe blue-sky growth to win from here; you need a normal cycle and disciplined execution. If public markets won’t pay up for that, private buyers probably will.

Tobias Newton is an Equity Analyst and Assistant Portfolio Manager at Octagon Asset Management.

Disclaimer: This article has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. This article does not contain financial advice. Some of the Octagon portfolios may own securities issued by companies mentioned in this article.

Octagon Asset Management is the investment manager for Octagon Investment Funds and the Summer KiwiSaver scheme.

Related reading

CSL and Fisher & Paykel Healthcare (FPH) were working their…

At first glance, the recent surge in Briscoes’ share price might imply a significant earnings beat, takeover speculation, or p…

The last two or three years have seen the Official Cash Rate (OCR), and other short-term interest rates, touch heights not seen since before the …

Fittingly for an industry bu…

The past couple of years have been challenging for domestic bond investors. The Bloomberg N…

The core concept of Environmental, Social, and Governance (ESG) has existed for centuries, dating back to religious codes banning investments in slave labour, through to div…

It is no secret that us New Zealanders love to invest in property as a way of building wealth. …

Kiwi households have almost NZ$250 billion sitting in their bank accounts - that's more than double all of th…

For investors that hold assets denominated in a foreign currency, there is both a direct exposure to exchange rate risk, as well as the price risk of the a…

Octagon looks to enhance the returns for our customers by being an active manager in the markets we invest in. This means, by definition and sty…

Bonds are often seen as less glamorous, less volatile, and basically boring when compared with the high-octane, high-ris…

Diversification is the great free lunch in investing – a …

to streamline the post-election government formation process.

Waiting for Godot, by Irish playwright Samuel Beckett, is a tragicomedy in two act…

More than a half-century ago, in November 1971, the then Prime Minister of New Zealand Keith Holyoake flew to Invercarg…

Say we flip a coin. Heads or tails? Heads – you may carry on exactly as you are now. Tails – 77% of your revenue strea…

How profitable are New Zealand’s banks? Seems a fair question aft…

In a July 2022 article we covered the basics of New Zealand Government inflation-linked bonds; how the…

A paper by the International Monetary Fund titled ‘The Long-Run Behaviour of Commodity Prices:…

With its mild weather, beautiful beaches, bountiful natural resources, and economic performance, Australia is often described as the lucky country (…

The term ESG (Environmental, Social and Governance) was officially coined in a 2…

New Zealand net migration has been a hot topic of late. As our econo…

One of the simplest truisms in investing is that share prices follow profits – on average, over the long term. Perh…

A few years back I read a book by Daniel Kahneman, Thinking Fast and Slow. It coined a phrase that captures the way I think about volatil…

Inflation-linked bonds are another option for income investors.

Today, we’re going to discuss wha…

The effects of Covid continue to reverberate throughout New Zealand more than two years after…

Where we came from

The boom in New Zealand’s property market has been extremely…