Passive Investing is Impassive on Valuation

Published January 2025

Author:

It’s difficult to approach the topic of passive investing without acknowledging my inherent bias. After all, my career has been built on the premise that active investing adds value. Much like fellow Margin Call contributor Nicholas Bagnall’s recent article on Tesla, I will attempt to set my biases aside—though, like him, I suspect I shall not succeed.

The rise of passive investing has reshaped global financial markets, offering investors low-cost, diversified portfolios that often track major indices. New Zealand is no exception. The proportion of funds flowing into passive vehicles has steadily increased, and while the appeal is undeniable—especially given that S&P’s SPIVA survey shows 77% of large-cap equity funds underperformed the S&P index on a net-of-fees basis over the five years to June 2024—the unintended consequences of this shift, particularly for the NZX50, deserve closer scrutiny.

Passive Investing's Growing Influence in New Zealand

Passive inflows now account for more than 50% of all inflows into US markets (Morningstar, 2023) and New Zealand is no different, with the share of investment funds flowing into passive vehicles steadily increasing year over year. KiwiSaver’s rapid expansion has been a significant driver of this growth, with multiple default funds utilising passive strategies to minimize costs. While these products make investing more accessible and affordable, they also have the potential to distort smaller markets like New Zealand’s.

When passive investors buy an ETF that tracks the NZX50, capital is allocated based on market capitalization rather than company fundamentals. This can create a self-fulfilling prophecy—larger companies receive more investment, inflating their valuations regardless of their underlying performance. In contrast, active investors play a crucial role in price discovery by analysing fundamentals and allocating capital accordingly. However, as passive inflows grow, this mechanism weakens, and prices begin to reflect index inclusion rather than company-specific merit. The smaller and less liquid a market, the more likely the impacts are going to be meaningful.

Fisher & Paykel Healthcare: A Case Study in Valuation Distortion

The distortive effects of passive investing can be seen in several instances—but one example at the forefront of my mind is Fisher & Paykel Healthcare (FPH). As the largest constituent of the NZX 50, FPH currently accounts for a staggering 17% of the index. This means that any investment into an NZX 50-tracking ETF results in significant capital flowing into FPH, irrespective of its valuation or fundamentals.

To be clear, passive flows are not the only reason behind FPH’s 60% share price increase last year. The company had a strong year, executing on new segment growth and delivering EPS expansion. However, my concern lies with the “irrespective of valuation” aspect. Currently, FPH trades at a one-year forward price-to-earnings (P/E) ratio of 55x—well above both its ten-year historical average and the industry peer average of 31.6x. As an analyst, I must ask: is that valuation justified?

In financial modelling, it’s easy for assumptions to become biased. To counter this, we continually test our assumptions through sensitivity analysis and valuation cross-checks. One approach is to reverse-engineer a company’s current share price to determine the implied assumptions and then assess whether those assumptions are realistic. Coincidentally (or perhaps not), sell-side consensus target prices closely align with FPH’s current share price. This enables me to cross-reference the assumptions embedded in their DCF models and assess what must be believed for FPH’s valuation to hold.

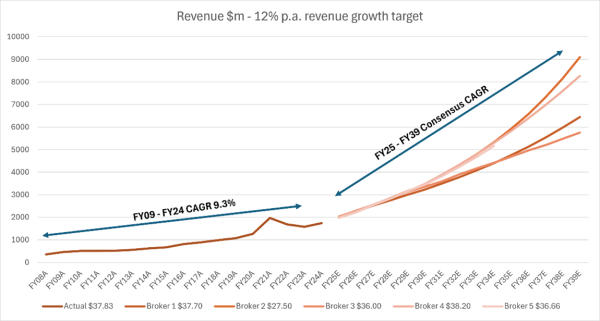

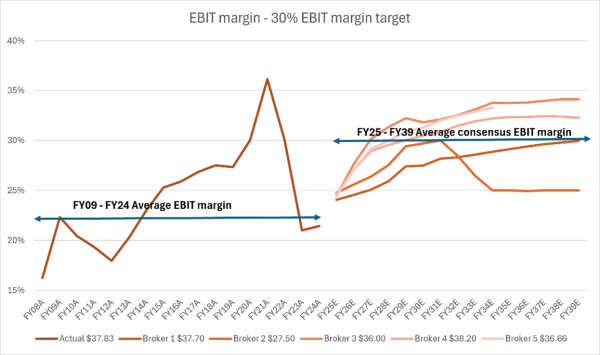

FPH has set two aspirational targets: 12% annual revenue growth and a 30% EBIT margin. To provide a market reference, I have charted the historical annual revenue growth and EBIT margins for the past 15 years and compared them to sell-side consensus forecasts for the next 15 years. Looking at the historical data, FPH’s revenue CAGR over the past 15 years has been 9.3%, yet consensus forecasts expect this to accelerate to 10.3% p.a. for the next 15 years. Even more strikingly, consensus projects EBIT margins to climb beyond the company’s aspirational 30% target into the mid-30s—despite FPH’s historical EBIT margin averaging just 23% over the past 15 years.

I am not suggesting these forecasts are impossible—I certainly don’t claim to predict the next 15 years with certainty (if I could, I’d be retired by now). However, what this does suggest is that a near-perfect track record for the next decade and a half is already priced into FPH’s valuation. That, in turn, skews the risk disproportionately to the downside.

The Risk of Passive-Driven Price Distortions

FPH’s elevated valuation creates the potential for a valuation bubble. Investors buying passive ETFs may not realize they are paying a significant premium for a single stock simply because of its weight in the index. This can lead to amplified downside risk—if FPH’s performance falters, its index weight will shrink, causing passive funds to slow or halt the flow of capital toward the stock. The lack of support can potentially see the price drift down further in a self-reinforcing decline. In other words, index funds could end up systematically buying high and selling low.

The Case for Active Management

Now is a good time to highlight an often-overlooked fact: active managers in New Zealand have, in many cases, outperformed their passive counterparts. Looking at data from the MJW Investment Survey for the year ended December 2024:

• 100% of the 13 wholesale New Zealand equity funds (those with less than 10% invested in Australia) outperformed the S&P/NZX50 index before fees and taxes over three- and five-year periods, with 85% outperforming over one year.

• 100% of the seven purely New Zealand-focused wholesale equity funds (those with no Australian exposure) outperformed the index before fees and taxes over three- and five-year periods, with 86% outperforming over one year.

Even after adjusting for standard wholesale fees, these numbers hold, painting a stark contrast to SPIVA’s 77% underperformance statistic. While passive investing may be distorting capital allocation, active managers can capitalize on the inefficiencies that passive flows can create.

FPH serves as an example of how passive flows can drive valuations beyond what fundamentals might support, increasing downside risk for investors who may not fully appreciate the premium they are paying. In this environment, active managers have an opportunity—and perhaps an obligation—to provide the counterbalance that markets need. The rise of passive investing is unlikely to slow anytime soon, but investors should remain mindful of its potential pitfalls. After all, the market only works efficiently when price and value remain connected—and that connection weakens when capital flows without regard for fundamentals.

Paige Hennessy is an Equities Analyst at Octagon Asset Management

Disclaimer: This article has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. This article does not contain financial advice. Some of the Octagon portfolios own securities issued by companies mentioned in this article.

Octagon Asset Management is the investment manager for Octagon Investment Funds and the Summer KiwiSaver scheme.

Related reading

CSL and Fisher & Paykel Healthcare (FPH) were working their…

At first glance, the recent surge in Briscoes’ share price might imply a significant earnings beat, takeover speculation, or p…

The last two or three years have seen the Official Cash Rate (OCR), and other short-term interest rates, touch heights not seen since before the …

Fittingly for an industry bu…

The past couple of years have been challenging for domestic bond investors. The Bloomberg N…

The core concept of Environmental, Social, and Governance (ESG) has existed for centuries, dating back to religious codes banning investments in slave labour, through to div…

It is no secret that us New Zealanders love to invest in property as a way of building wealth. …

Kiwi households have almost NZ$250 billion sitting in their bank accounts - that's more than double all of th…

For investors that hold assets denominated in a foreign currency, there is both a direct exposure to exchange rate risk, as well as the price risk of the a…

Octagon looks to enhance the returns for our customers by being an active manager in the markets we invest in. This means, by definition and sty…

Bonds are often seen as less glamorous, less volatile, and basically boring when compared with the high-octane, high-ris…

Diversification is the great free lunch in investing – a …

to streamline the post-election government formation process.

Waiting for Godot, by Irish playwright Samuel Beckett, is a tragicomedy in two act…

More than a half-century ago, in November 1971, the then Prime Minister of New Zealand Keith Holyoake flew to Invercarg…

Say we flip a coin. Heads or tails? Heads – you may carry on exactly as you are now. Tails – 77% of your revenue strea…

How profitable are New Zealand’s banks? Seems a fair question aft…

In a July 2022 article we covered the basics of New Zealand Government inflation-linked bonds; how the…

A paper by the International Monetary Fund titled ‘The Long-Run Behaviour of Commodity Prices:…

With its mild weather, beautiful beaches, bountiful natural resources, and economic performance, Australia is often described as the lucky country (…

The term ESG (Environmental, Social and Governance) was officially coined in a 2…

New Zealand net migration has been a hot topic of late. As our econo…

One of the simplest truisms in investing is that share prices follow profits – on average, over the long term. Perh…

A few years back I read a book by Daniel Kahneman, Thinking Fast and Slow. It coined a phrase that captures the way I think about volatil…

Inflation-linked bonds are another option for income investors.

Today, we’re going to discuss wha…

The effects of Covid continue to reverberate throughout New Zealand more than two years after…

Where we came from

The boom in New Zealand’s property market has been extremely…