Higher risk-adjusted returns; get yourself a ladder

Published May 2024

Author:

The theory and practice of currency hedging

For investors that hold assets denominated in a foreign currency, there is both a direct exposure to exchange rate risk, as well as the price risk of the actual international assets.

For example, a New Zealand (NZ) investor who buys shares in Microsoft Corp – a US-listed stock, denominated in United States dollars (USD), has exposure not only to the Microsoft business and operating profits but also movements of the New Zealand dollar (NZD) exchange rate against the USD.

An investor must make an active decision as to whether they want exposure to both exchange rate risk and equity risk, or just the latter. If the latter they can use currency hedging as a way to mitigate the risk associated with the currency exposure, with the idea of reducing the total investment risk and potentially improving risk-adjusted returns.

As far as I can see from a quick internet research, many NZ funds offer either a fully unhedged product, a close to fully hedged (if not fully hedged) product or a 50% hedged product. Very few funds offer an active strategy to foreign currency hedging.

One theory of running with an unhedged portfolio is that it provides a cushion against global shocks. A collapse in foreign asset values tends to correspond with a depreciation of the NZD, in particular against the USD. This was exactly what we saw play out during COVID. From late December 2019 to the COVID market lows of 23 March 2020 (which your writer remembers as a rather stressful day trading equities as some of us were out stockpiling toilet paper!!) the S&P index fell 31%. At the same time the NZD fell almost 16% meaning an investor running with an unhedged portfolio protected around 40% of their losses.

Over the following year equity markets recovered strongly as did the NZD and the opposite occurred. An unhedged investor would have “lost” over half their equity gains from the market lows. The genius move (aren’t we all geniuses in hindsight?), would have been running a ‘naked’ or unhedged hedging strategy into the downturn and then putting hedging on as equity markets and the NZD both bottomed out on 23 March 2020, crystallising the FX gains. In reality picking the exact bottom of any market, equity or currency, is a fool’s errand but many of us did add to our hedging position during that period to lock-in some extra gains.

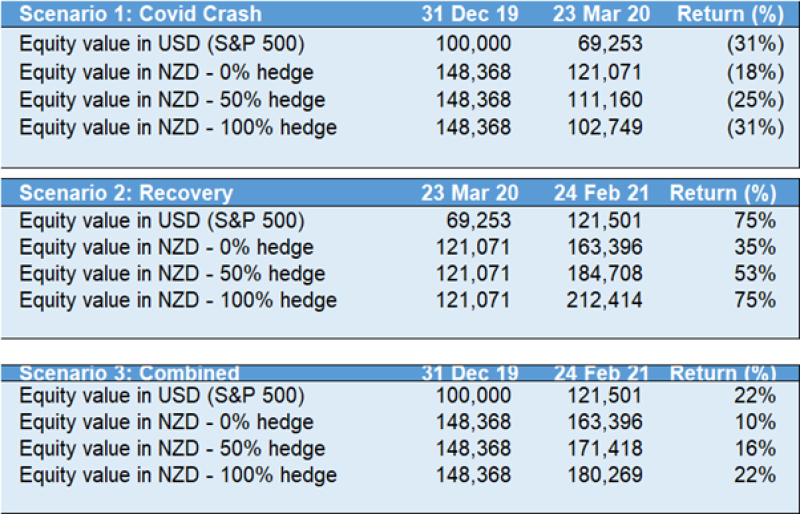

In the tables below we show a simplistic example highlighting the impact on an investor’s portfolio if they were 100% invested in the S&P500 index (ignoring fees, dividends and attached taxes, forward point differentials, and tax on hedging) over those two time periods assuming the investor was 0% hedged, 50% hedged, and 100% hedged. The last table assumes the same currency strategy was in place over the combined period and highlights a “win” for the 100% hedged investor as the NZD appreciated against the USD from 67c to 74c. The opposite could equally be the case if the NZD had depreciated over that period.

As an aside, if you were running a fully hedged portfolio during that COVID crash period (when the NZD materially depreciated) the cash calls from the counterparty could have been significant. You would not have benefited from the offset in NZD asset values as the currency fell and you may have had to sell equities at the bottom to fund margin calls (excuse the pun!!) to the counterparty (most likely a bank).

The ladder approach

An active investment manager can utilise a different solution whereby they can regularly assess the hedge level of the portfolio (at Octagon, this is at least a monthly review and often more frequently) depending on where the NZD sits against a basket of currencies that make up the bulk of the underlying foreign investments. The investment manager can then move up and down the hedging ladder depending on where the NZD sits against each of those currencies.

This ladder builds on the belief that the NZD mean reverts to a real exchange rate reflecting the relative purchasing power of the two countries. The investment manager can adjust the hedge positioning when the currencies trade at certain degrees of variance from the fair value.

At fair value between the two currencies a portfolio will be 50% hedged. When the NZD is materially below this trend value (i.e. cheap) the portfolio will run a higher hedged positon (Octagon sets this limit at 80% hedged), and when the NZD is materially above this long term trend value (i.e. expensive) the investment manager can lower the hedge ratio (for clarity Octagon sets this lower hedge limit at 20%).

The active investment manager can move between these two levels based on the volatility of the currency pair. Estimating fair value estimates from data provided by major commercial banks and a rigorous back-testing of the theory complements the hedging strategy. Importantly these hedging calls are not a short term forecast for the exchange rate which can be affected by a broad range of macro drivers like interest rate differentials, relative macroeconomic performance and foreign investment flows, rather are calculated over longer time periods to account for these short term market shifts.

Dynamic hedging can be an effective strategy to gain risk efficient exposure to global equities, by controlling and capitalising on exchange rate movements. Back-testing the currency ladder hedging strategy over a long time period shows an active investment manager can likely achieve a higher Sharpe ratio (comparing the return of an investment with its risk) by adopting a ladder approach versus the three most commonly used alternatives; fully unhedged, fully hedged and 50% hedged.

As with anything, there is no free lunch

There is of course a cost to hedging, for starters the bank has to get paid. The cost of this is difficult to calculate exactly as spreads vary by trade, currency, tenor, and interest rate differential but we estimate this to be negligible versus running an unhedged portfolio.

The implementation of a ladder approach take time. At a minimum this strategy should see (likely staggered) hedges rolled (and hedge levels adjusted) each month, or your investment manager may be even more granular rolling hedges intra-month in times of large moves in either equity markets and/or currency exchange rates.

One theory in support of being unhedged is that it does provide a degree of currency diversification. Most NZ investors earn their income in NZ, and own their largest assets (their house) in NZ. If their wealth is highly dependent on the NZ economy and the NZD, unhedged international investments do provide a degree of diversification. If a localised, specific event was to happen in NZ (think something along the lines of mad cow disease or a large natural disaster) the consequence could be extremely damaging to the NZ economy however in such an event it is likely the NZD would depreciate increasing the value of your unhedged global investments.

Currencies can go through prolonged return cycles which can take them far away from what economists would consider fair value. It is not unusual to see the market exchange rate deviate materially from the ‘fair value’ or purchasing power parity (PPP) rate for a period of time; market participants have seen this recently with the NZD/JPY cross. However, when the exchange rate varies meaningfully from PPP, there is a tendency for it to revert to fair value over time.

Octagon agrees with the conclusions of a paper written back in 2016 by Russell, that a dynamic approach can give investors the chance to have the best of both worlds. That is they can take advantage of rewarded currency factors and market dislocation targeting positive returns, and the potential to reduce large negative cash flows from static currency hedging.

Disclaimer: This article has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. This article does not contain financial advice. Some of the Octagon portfolios own securities issued by companies mentioned in this article.

Related reading

CSL and Fisher & Paykel Healthcare (FPH) were working their…

At first glance, the recent surge in Briscoes’ share price might imply a significant earnings beat, takeover speculation, or p…

The last two or three years have seen the Official Cash Rate (OCR), and other short-term interest rates, touch heights not seen since before the …

Fittingly for an industry bu…

The past couple of years have been challenging for domestic bond investors. The Bloomberg N…

The core concept of Environmental, Social, and Governance (ESG) has existed for centuries, dating back to religious codes banning investments in slave labour, through to div…

It is no secret that us New Zealanders love to invest in property as a way of building wealth. …

Kiwi households have almost NZ$250 billion sitting in their bank accounts - that's more than double all of th…

Octagon looks to enhance the returns for our customers by being an active manager in the markets we invest in. This means, by definition and sty…

Bonds are often seen as less glamorous, less volatile, and basically boring when compared with the high-octane, high-ris…

Diversification is the great free lunch in investing – a …

to streamline the post-election government formation process.

Waiting for Godot, by Irish playwright Samuel Beckett, is a tragicomedy in two act…

More than a half-century ago, in November 1971, the then Prime Minister of New Zealand Keith Holyoake flew to Invercarg…

Say we flip a coin. Heads or tails? Heads – you may carry on exactly as you are now. Tails – 77% of your revenue strea…

How profitable are New Zealand’s banks? Seems a fair question aft…

In a July 2022 article we covered the basics of New Zealand Government inflation-linked bonds; how the…

A paper by the International Monetary Fund titled ‘The Long-Run Behaviour of Commodity Prices:…

With its mild weather, beautiful beaches, bountiful natural resources, and economic performance, Australia is often described as the lucky country (…

The term ESG (Environmental, Social and Governance) was officially coined in a 2…

New Zealand net migration has been a hot topic of late. As our econo…

One of the simplest truisms in investing is that share prices follow profits – on average, over the long term. Perh…

A few years back I read a book by Daniel Kahneman, Thinking Fast and Slow. It coined a phrase that captures the way I think about volatil…

Inflation-linked bonds are another option for income investors.

Today, we’re going to discuss wha…

The effects of Covid continue to reverberate throughout New Zealand more than two years after…

Where we came from

The boom in New Zealand’s property market has been extremely…