Heads or Tails? How to value regulatory risk

Published July 2023

Author:

ANALYSIS: What Pacific Edge and SkyCity teach us about managing regulatory risk.

Say we flip a coin. Heads or tails? Heads – you may carry on exactly as you are now. Tails – 77% of your revenue stream will cease to exist in a month.

This is the scenario NZX-listed Pacific Edge Ltd (PEB) has been facing ever since a proposed amendment by Medicare policy maker Novitas sought to exclude its Cxbladder tests from reimbursement coverage. Medicare reimbursement accounts for approximately 77% of Pacific Edges’ current financial year’s revenue, making the outcome of the proposal material in the valuation of Pacific Edge.

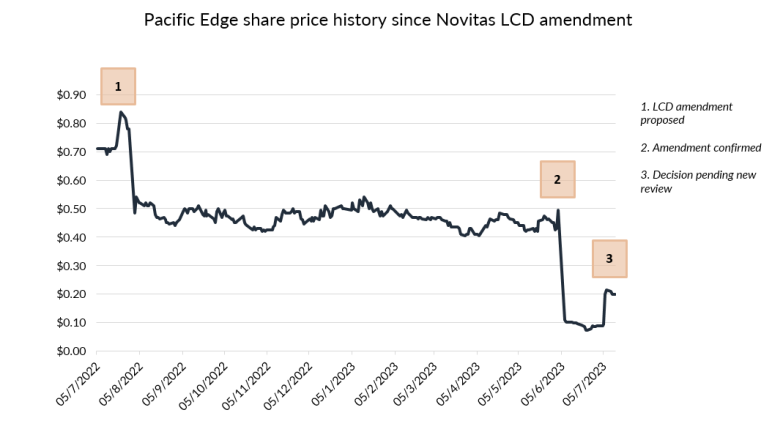

Since then, the future of Pacific Edge has essentially become a coin toss, and this uncertainty is well evidenced in its price volatility since. As the proposal first came to light, its share price nearly halved from $0.84 to $0.47. When the amendment was confirmed, the price shed 85% in a single day, touching a low of $0.07 before coming to rest at $0.12. In recent weeks, the saga has continued, with the share price surging 150% in a matter of minutes after its coverage was given a stay of execution while the proposal and its decision-making process is revisited following industry feedback.

Source: Refinitiv

Very real risk in financial markets

Pacific Edge stands to highlight a very real risk that occurs in financial markets: that regulatory intervention, particularly singular decision interventions, can create binary outcomes often with skewed return profiles.

In its simplest form, when the government and its agencies administer controls over the activities of private firms, capital invested in those firms can become exposed to additional risk. The key problem is that, due to regulation varying across agencies and industries, the ‘regulatory’ risk that occurs in a stock can arise in many forms, with diversified consequences.

It is this variability of outcomes that means the nature of the regulatory risk is not well understood, limiting the extent to which the costs of regulatory risk can be estimated in the context of stock valuations.

Strategies of portfolio investors depend on their expectations about the future returns achievable across the entire range of possible stocks (for example). Investors’ beliefs about the future distribution of returns, combined with information on the returns available for alternative stocks determines the cost to the firm of retaining market support. When future distribution of returns are at risk, this naturally leads to a higher cost of support and a lower valuation.

How do you value regulatory risk?

The question for investors becomes: how can I get confidence on the future distribution of returns to the point where I think the current valuation warrants investing?

In simple terms, how do you value regulatory risk?

One of the more common approaches is probability weighting valuations based on a number of potential outcomes. For example, if we return to the coin toss: you could simply say there is a 50% probability that the business will lose all of the revenue associated with the decision, and there is a 50% probability that the business pre-intervention is its true and fair value. The resultant valuation could see the share price half, somewhat like occurred to Pacific Edge after its initial announcement, when information was limited and being freshly digested by the market.

But, in reality, it is never that simple. These matters can be further complicated when the regulatory risk presents itself as a sequence of decisions, each decision creating further murkiness as to the final outcome.

For Pacific Edge, the outcome is clear, either they have coverage or they don’t, but this is not the case for all. Local casino operator SkyCity (SKC) is a prime example of this.

Punitive actions pending

SkyCity is facing punitive actions from both Australian financial crime watchdog Austrac and the South Australian government for alleged anti-money laundering (AML) failures in its Adelaide casino.

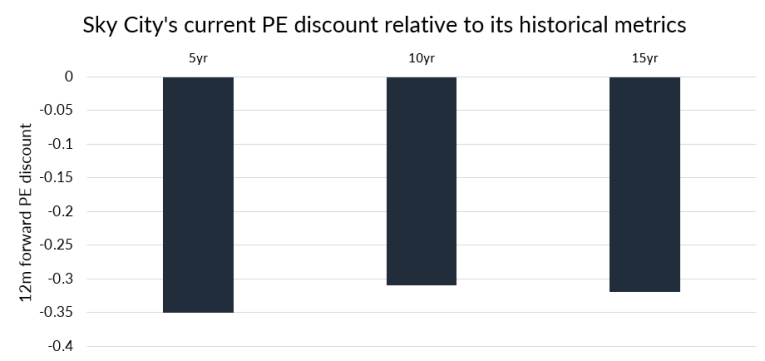

This follows similar proceedings against Australian-listed peers Star and Crown, of whom the latter – who is furthest through proceedings – has been slapped with a total A$650 million in fines from the Victorian government and Austrac for its own AML failings. In the 15 years prior to this regulatory intervention, SkyCity has had a strong price to earnings (PE) relationship to the New Zealand market median and traded at a relatively stable 12-month forward PE of around 15x. It now trades at a respective -35% and -30% discount to these historical metrics. On a multiple basis, if you applied its historical PE to one year forward market consensus, then Sky City is worth roughly $3.10 versus the $2.34 it trades at today, not factoring in that the business is undergoing a Covid recovery resulting in a depressed forward earnings estimate.

While there is no specific precedent for how these penalties are calculated, the broker analysts in the market are typically sizing the combined penalty from these fines at around A$150m, roughly accounting for a $0.20 per share hit to the share valuation.

This begs the question of what then is causing a $0.75 valuation gap to historical metrics to arise? It comes down to the fact that, beyond the known Australian investigations, a poor outcome over there could lead to further regulatory risks this side of the Tasman that also sit in the background. The most material being regulatory contagion to the New Zealand properties, particularly the Auckland property.

The dollar value and probability of those risks are even harder to estimate, and hence the valuation impact on SkyCity should reasonably sit in a very wide range.

Source: Refinitiv

High level of reward

As we know – with risk should come return.

Where an investor can gain confidence in their valuation, given their assessment of the perceived downside, and how much of that is already reflected in the share price, there can be a high level of reward achieved.

Of course, the problem with binary risks is that the ‘expected’ value is always wrong. It is either this value or that value, not a probability weighted value somewhere between the two.

Perhaps proprietary research can give you confidence on one outcome or the other, or perhaps the share price already reflects 100% of the value loss you expect on a negative outcome – the rare but wonderful ‘free option’. In those cases, the investor will not think they are speculating on an unknowable, rather investing in a mispricing of risk with the potential of outsized returns.

Disclaimer: This article has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. This article does not contain financial advice. Octagon Asset Management is the investment manager for portfolios that own securities issued by companies mentioned in this article. This article was supplied to NBR and first published 18 July 2023.

Related reading

CSL and Fisher & Paykel Healthcare (FPH) were working their…

At first glance, the recent surge in Briscoes’ share price might imply a significant earnings beat, takeover speculation, or p…

The last two or three years have seen the Official Cash Rate (OCR), and other short-term interest rates, touch heights not seen since before the …

Fittingly for an industry bu…

The past couple of years have been challenging for domestic bond investors. The Bloomberg N…

The core concept of Environmental, Social, and Governance (ESG) has existed for centuries, dating back to religious codes banning investments in slave labour, through to div…

It is no secret that us New Zealanders love to invest in property as a way of building wealth. …

Kiwi households have almost NZ$250 billion sitting in their bank accounts - that's more than double all of th…

For investors that hold assets denominated in a foreign currency, there is both a direct exposure to exchange rate risk, as well as the price risk of the a…

Octagon looks to enhance the returns for our customers by being an active manager in the markets we invest in. This means, by definition and sty…

Bonds are often seen as less glamorous, less volatile, and basically boring when compared with the high-octane, high-ris…

Diversification is the great free lunch in investing – a …

to streamline the post-election government formation process.

Waiting for Godot, by Irish playwright Samuel Beckett, is a tragicomedy in two act…

More than a half-century ago, in November 1971, the then Prime Minister of New Zealand Keith Holyoake flew to Invercarg…

How profitable are New Zealand’s banks? Seems a fair question aft…

In a July 2022 article we covered the basics of New Zealand Government inflation-linked bonds; how the…

A paper by the International Monetary Fund titled ‘The Long-Run Behaviour of Commodity Prices:…

With its mild weather, beautiful beaches, bountiful natural resources, and economic performance, Australia is often described as the lucky country (…

The term ESG (Environmental, Social and Governance) was officially coined in a 2…

New Zealand net migration has been a hot topic of late. As our econo…

One of the simplest truisms in investing is that share prices follow profits – on average, over the long term. Perh…

A few years back I read a book by Daniel Kahneman, Thinking Fast and Slow. It coined a phrase that captures the way I think about volatil…

Inflation-linked bonds are another option for income investors.

Today, we’re going to discuss wha…

The effects of Covid continue to reverberate throughout New Zealand more than two years after…

Where we came from

The boom in New Zealand’s property market has been extremely…