Covid tailwinds unwind for NZ retailers

Published May 2022

Author:

ANALYSIS: The pandemic has played havoc with earnings comparisons but market indicators do not bode well.

The effects of Covid continue to reverberate throughout New Zealand more than two years after the pandemic first struck.

The first year of the pandemic propelled some industries to record profitability while others fell behind.

As the market recovered from its March 2020 bottom, the spread between the best and worst-performing sectors expanded. With the average retailer delivering a total return (being change in share price plus gross dividends) to shareholders of 138% between March and December 2020, versus 54% for the broader NZX50, it is no secret they have been among the most acute of Covid beneficiaries.

Forced to shutter stores overnight and rapidly adjust to changing restrictions, retailers have seen the impact of Covid give way to new customer behaviours and operational practices that look set to permanently reshape the industry.

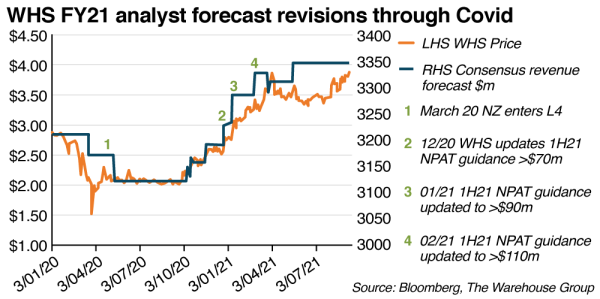

In March 2020, as the first lockdown loomed and our borders were shut, analysts downgraded forecasts for retailers on a stunted sales outlook. However, consumers confined indoors were not idle, using savings typically reserved for holidays and experiences to renovate, set up a home office, and pick up a new hobby.

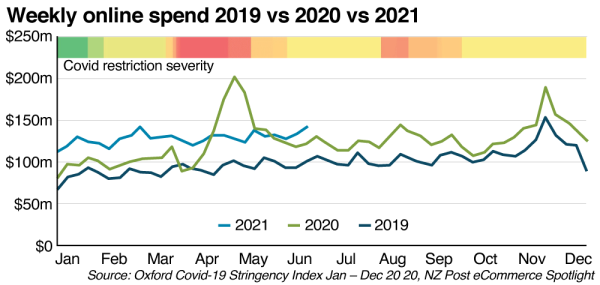

Loosening of restrictions was met with a reopening resurgence of in-store sales and the sporadic lockdowns that followed were similarly met with a fast-paced shift to online spending that peaked in April 2020 when the country was in the midst of its strictest Covid restrictions, according to the Oxford Stringency Index.

What played out over 2020 and most of 2021 was a series of forecast upgrades for retail powerhouses – such as The Warehouse (WHS), Michael Hill (MHJ), and Briscoe (BGP) – with all three retailers reporting record earnings for FY21.

While top line sales broadly increased, profitability was enhanced by a perfect storm of favourable product mix, higher order values and conversion rates, and greater flexibility to employ structural cost-out and other operational improvements. Combining these factors alongside operating leverage gains from the sales upside led to a gross margin and ebit margin uplift of ~200 to 400 basis points across the board.

The timing of Covid enveloped a number of internal transformation initiatives undertaken by the retailers, creating ambiguity as to what are sustainable operating improvements and what is purely a Covid benefit, and therefore likely to dissipate as Covid winds down.

Fast-forward to now, and the retail landscape has begun to depict a different story, with several pain-points erupting, causing retailer performance to lag the broader New Zealand equity market through 2022 to date.

Supply chain disruption

Lockdowns, Covid outbreaks, and the surge in consumer demand for goods over the past two years has led to significant supply chain disruption and a meteoric rise in freight costs. This disruption is showing up in multiple ways; one only needs to look to KMD Brands’ most recent result to see evidence of that.

Despite record demand, only 50% of orders for its footwear brand Oboz were able to be fulfilled due to lockdowns in Vietnam. A global neoprene shortage has hampered its supply of wetsuits for Rip Curl and inventory has peaked at an all-time high of $250m as it attempts to mitigate increased production lead times and international shipping delays. KMD Brands is certainly not alone, with the New York Fed Global Supply Chain Pressure Index (GSCPI) only recently off its peak.

While the GSCPI shows pressure dissipating, the general expectation is that supply chain normalisation will not occur until early 2023 at the earliest, as demand for goods declines and Covid absenteeism drops off. This expectation is most at threat from the current lockdowns in China as its government continues its commitment to a zero-Covid approach.

While Shanghai Port remains open, shipping containers continue to back up due to a shortage of trucking labour. While Shanghai cargo is getting diverted to Ningbo, the world’s third-busiest port has also now become congested with shippers and carriers facing lengthening vessel wait times.

Just last week, Tesla reopened its factory on a closed-loop basis, with staff sleeping in the factory in order to continue operating under the current Covid restrictions. For most retailers, stock shortages are appearing in pockets and inventory build across the industry is apparent in an attempt to circumvent empty shelves. From here on out, a balancing game must be played between holding enough stock to meet demand and avoiding inventory obsolescence should demand drop off sharply later this year.

Inflation and interest rates

Though not the root cause, supply chain disruption has undoubtedly played its part in New Zealand experiencing its highest level of inflation since 1990, with the March quarterly CPI printing 6.9% and Reserve Bank Governor Adrian Orr conceding the central bank is “not in a great place now” with inflation.

With wages lagging and food and petrol costs up 6.7% and 32% year-on-year respectively, the purchasing power of our pay cheque continues to shrink. Couple this with the fact that half of New Zealand mortgages are due to roll off a fixed interest rate this year, with many secured during Covid rolling into a much higher number. In March 2021 the average five-year mortgage rate being taken out by borrowers was 3.78%, but this has since risen to 5.89%. With further OCR hikes on the horizon, a high proportion of borrowers are facing dramatically higher debt servicing costs in the coming period.

Discretionary spend

As real discretionary income is squeezed by inflation, consumers have to rationalise their spending between essentials and discretionary items. With borders reopening and hospitality spend on the rise, retailers have to battle with competing categories for the first time in two years.

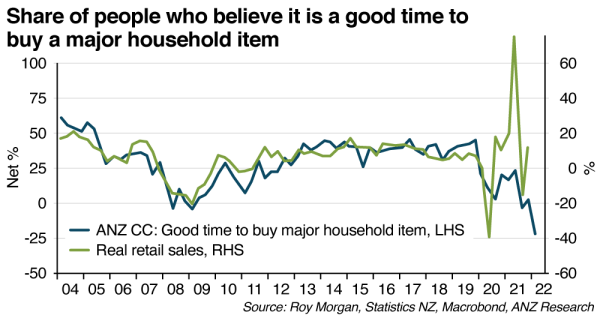

Recent data showed a rebound in restaurant bookings from OpenTable, at 160% of pre-Covid levels on a weekly basis. Consumer confidence in March dropped to its lowest reading since the Roy Morgan survey began in 2004.

The most useful indicator from a retail activity perspective is ‘the share of people who believe it is a good time to buy a major household item’ which fell five points to a net -26%, testing record lows. While Covid has created volatility, there is typically a clear relationship between the answer to this question and retail sales, which does not bode well for retailers, with confidence below the 2007/08 GFC trough.

With inflation running near 7%, the implied fall in nominal revenue is less dramatic than real sales decline, though this likely provides little comfort for retailers holding more inventory than usual due to the supply chain disruptions.

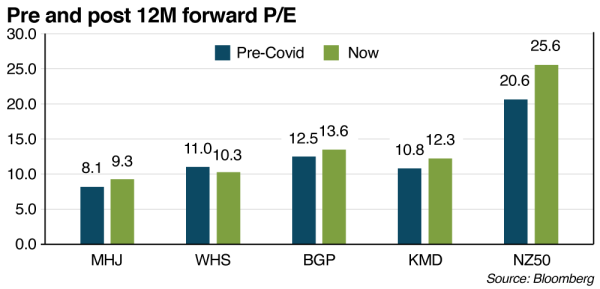

These concerns are not in any way novel and are reflected in the disparity between the re-rating of the current 12-month forward P/E for the NZX50 relative to its pre-Covid three-year average and that of the retailers. While valuations from gentailers and property stocks have inflated the NZX50 multiple, there is a stark contrast between its re-rating upwards and a broadly flat performance from the retailers. This stands to evidence that the market is expecting earnings downgrades for the retailers in a post-Covid world with little market belief in structural changes implemented by management.

The pandemic has made the past two years of earnings, margins, and same store sales prints near illegible in terms of comparability. Determining whether there is a retailer in the mix that has used Covid as an opportunity to come out of the pandemic a structurally better business, permanently retaining higher margins, or a larger market share, is a key question we ask ourselves. As the world reopens, there will be a new level-setting on growth, transformation, and capital investment. The skill from here is picking what is already factored into the stock price.

Related reading

CSL and Fisher & Paykel Healthcare (FPH) were working their…

At first glance, the recent surge in Briscoes’ share price might imply a significant earnings beat, takeover speculation, or p…

The last two or three years have seen the Official Cash Rate (OCR), and other short-term interest rates, touch heights not seen since before the …

Fittingly for an industry bu…

The past couple of years have been challenging for domestic bond investors. The Bloomberg N…

The core concept of Environmental, Social, and Governance (ESG) has existed for centuries, dating back to religious codes banning investments in slave labour, through to div…

It is no secret that us New Zealanders love to invest in property as a way of building wealth. …

Kiwi households have almost NZ$250 billion sitting in their bank accounts - that's more than double all of th…

For investors that hold assets denominated in a foreign currency, there is both a direct exposure to exchange rate risk, as well as the price risk of the a…

Octagon looks to enhance the returns for our customers by being an active manager in the markets we invest in. This means, by definition and sty…

Bonds are often seen as less glamorous, less volatile, and basically boring when compared with the high-octane, high-ris…

Diversification is the great free lunch in investing – a …

to streamline the post-election government formation process.

Waiting for Godot, by Irish playwright Samuel Beckett, is a tragicomedy in two act…

More than a half-century ago, in November 1971, the then Prime Minister of New Zealand Keith Holyoake flew to Invercarg…

Say we flip a coin. Heads or tails? Heads – you may carry on exactly as you are now. Tails – 77% of your revenue strea…

How profitable are New Zealand’s banks? Seems a fair question aft…

In a July 2022 article we covered the basics of New Zealand Government inflation-linked bonds; how the…

A paper by the International Monetary Fund titled ‘The Long-Run Behaviour of Commodity Prices:…

With its mild weather, beautiful beaches, bountiful natural resources, and economic performance, Australia is often described as the lucky country (…

The term ESG (Environmental, Social and Governance) was officially coined in a 2…

New Zealand net migration has been a hot topic of late. As our econo…

One of the simplest truisms in investing is that share prices follow profits – on average, over the long term. Perh…

A few years back I read a book by Daniel Kahneman, Thinking Fast and Slow. It coined a phrase that captures the way I think about volatil…

Inflation-linked bonds are another option for income investors.

Today, we’re going to discuss wha…

Where we came from

The boom in New Zealand’s property market has been extremely…