Can income assets help protect your portfolio from inflation?

Published July 2022

Author:

ANALYSIS: Inflation acts like a tax, reducing the original purchasing power of the investor’s money.

Inflation-linked bonds are another option for income investors.

Related reading

Tale of Two Healthcare Heavyweights - February 2026

Rewind the clock two years, and the battle between the two healthcare giants in the Australian & New Zealand indices looked very different.

CSL and Fisher & Paykel Healthcare (FPH) were working their…

CSL and Fisher & Paykel Healthcare (FPH) were working their…

Should you care about Aged Care? - December 2025

It’s never easy to pick turning points for a particular company or the economy. But therein lies the opportunity. After a bruising few years, is now a good time to revisit the investment case for New …

Margin Call - August 2025

August is traditionally the busiest period of the year for domestic fund managers, as many NZX and ASX-listed companies release their June 30 year-end results. This is when large corporates provide a …

Briscoes Rockets into the NZX 50 - July 2025

What its recent surge says about the investing landscape in New Zealand.

At first glance, the recent surge in Briscoes’ share price might imply a significant earnings beat, takeover speculation, or p…

At first glance, the recent surge in Briscoes’ share price might imply a significant earnings beat, takeover speculation, or p…

Squeezing juice from a drying cash rate - June 2025

Yes, rates are falling—but your returns don’t have to

The last two or three years have seen the Official Cash Rate (OCR), and other short-term interest rates, touch heights not seen since before the …

The last two or three years have seen the Official Cash Rate (OCR), and other short-term interest rates, touch heights not seen since before the …

Is passive investing killing the IPO Star? - May 2025

The ceremonial ringing of the bell to mark a company’s debut on a stock exchange has long symbolised entrepreneurial triumph. From the NYSE to the NZX, a public listing was once considered the pinnacl…

NZME’s Governance Gren(on)ade - April 2025

James Grenon’s campaign to reshape NZME’s board signals more than shareholder activism — it’s a reminder of how fast governance risk can move from footnote to front page.

Fittingly for an industry bu…

Fittingly for an industry bu…

Sky TV's Rights Negotiation goes into Extra Time - February 2025

Price increases are never welcome but sometimes, on rare occasions, we can soften that blow by offsetting ourselves in the market. For instance, accepting a 12-14% insurance premium increase from your…

Passive Investing is Impassive on Valuation - January 2025

It’s difficult to approach the topic of passive investing without acknowledging my inherent bias. After all, my career has been built on the premise that active investing adds value. Much like fellow …

Credit where credit’s due - December 2024

Analysis: A well-diversified New Zealand bond portfolio should include both corporate and government bonds.

The past couple of years have been challenging for domestic bond investors. The Bloomberg N…

The past couple of years have been challenging for domestic bond investors. The Bloomberg N…

The ‘ins’ and ‘outs’ of ESG exclusions - November 2024

Margin Call November 2024

The core concept of Environmental, Social, and Governance (ESG) has existed for centuries, dating back to religious codes banning investments in slave labour, through to div…

The core concept of Environmental, Social, and Governance (ESG) has existed for centuries, dating back to religious codes banning investments in slave labour, through to div…

Asset rich, cash flow poor - October 2024

ANALYSIS: Synlait Milk is a case study for when asset backing is no longer enough to support valuation

It is no secret that us New Zealanders love to invest in property as a way of building wealth. …

It is no secret that us New Zealanders love to invest in property as a way of building wealth. …

Strategic Asset Allocation - September 2024

We’ve written about strategic asset allocation previously – the investment science behind the long- term allocation of investors’ capital across various asset classes. In our view, strategic asset al…

Stick or Twist? What the surprise RBNZ Pivot means for your portfolio - August 2024

What a difference a few words can make. On July 10th the Reserve Bank of New Zealand (RBNZ) Monetary Policy Committee (MPC) delivered a surprisingly ‘dovish’ and welcome surprise to the markets. These…

Cash is not always king - July 2024

Analysis: Are Kiwis using their cash investments wisely or are there better alternatives?

Kiwi households have almost NZ$250 billion sitting in their bank accounts - that's more than double all of th…

Kiwi households have almost NZ$250 billion sitting in their bank accounts - that's more than double all of th…

US Equities - simply momentum or something more fundamental - June 2024

The momentum run in the US market continues to be very strong. It resembles in many ways the peak rally in 1999 to early 2000, just before the “dot com” crash. Like that historic era, earnings growth …

Higher risk-adjusted returns; get yourself a ladder - May 2024

The theory and practice of currency hedging

For investors that hold assets denominated in a foreign currency, there is both a direct exposure to exchange rate risk, as well as the price risk of the a…

For investors that hold assets denominated in a foreign currency, there is both a direct exposure to exchange rate risk, as well as the price risk of the a…

How to build conviction in a portfolio - April 2024

Building active portfolios, building conviction levels

Octagon looks to enhance the returns for our customers by being an active manager in the markets we invest in. This means, by definition and sty…

Octagon looks to enhance the returns for our customers by being an active manager in the markets we invest in. This means, by definition and sty…

Winners and losers from reporting season - March 2024

The February reporting season seems to arrive faster every year and the reporting calendar seems to get more and more condensed. (Note to IR departments reading this, having 7 earnings results on the …

Signal to Noise - February 2024

Investment markets are forward looking. Public markets that trade daily, like equities and fixed interest, absorb all new information today to try and instantly work out what that means for future int…

Geopolitical Risks to your Portfolio in 2024 and Beyond - January 2024

Many of you checking your Kiwisaver and investment balances over the holidays would have been pleasantly surprised by the performance of your portfolios in the final months of the year. In the course …

Bonds. Global bonds. Stirred, not shaken - December 2023

ANALYSIS: The question is - international fixed interest, and if not, why not?

Bonds are often seen as less glamorous, less volatile, and basically boring when compared with the high-octane, high-ris…

Bonds are often seen as less glamorous, less volatile, and basically boring when compared with the high-octane, high-ris…

Investors should seek out best risk-adjusted returns - October 2023

ANALYSIS: More choices generally allow active managers to exhibit their skill level over time, versus short-term periods of good or bad luck.

Diversification is the great free lunch in investing – a …

Diversification is the great free lunch in investing – a …

Waiting for Winston; a tragicomedy brought to you by MMP - September 2023

ANALYSIS: Maybe there should be mechanisms introduced

to streamline the post-election government formation process.

Waiting for Godot, by Irish playwright Samuel Beckett, is a tragicomedy in two act…

to streamline the post-election government formation process.

Waiting for Godot, by Irish playwright Samuel Beckett, is a tragicomedy in two act…

Will Rio Tinto stay or will they go (now) - August 2023

ANALYSIS: For the first time Rio/NZAS do not hold all of the negotiating cards.

More than a half-century ago, in November 1971, the then Prime Minister of New Zealand Keith Holyoake flew to Invercarg…

More than a half-century ago, in November 1971, the then Prime Minister of New Zealand Keith Holyoake flew to Invercarg…

Heads or Tails? How to value regulatory risk - July 2023

ANALYSIS: What Pacific Edge and SkyCity teach us about managing regulatory risk.

Say we flip a coin. Heads or tails? Heads – you may carry on exactly as you are now. Tails – 77% of your revenue strea…

Say we flip a coin. Heads or tails? Heads – you may carry on exactly as you are now. Tails – 77% of your revenue strea…

Banking on Profits - June 2023

ANALYSIS: The fact NZ banks aren't taking on more risk than those in other countries, but generate far higher returns, is intriguing.

How profitable are New Zealand’s banks? Seems a fair question aft…

How profitable are New Zealand’s banks? Seems a fair question aft…

Active versus Passive - April 2023

Octagon Asset Management (Octagon) as an active investment manager and we aim to deliver superior investment returns by being active (as opposed to passive). Octagon uses its active approach to enhanc…

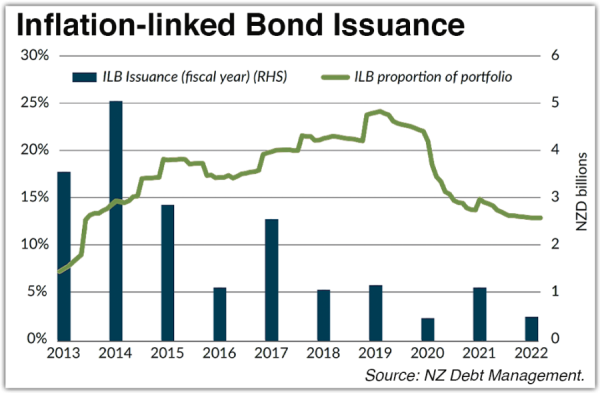

Inflation-linked bonds, revisited - April 2023

ANALYSIS: Inflation-linked bonds in high inflation times – good concept but how have they fared?

In a July 2022 article we covered the basics of New Zealand Government inflation-linked bonds; how the…

In a July 2022 article we covered the basics of New Zealand Government inflation-linked bonds; how the…

Commodities – a little bit of volatility anyone? - February 2023

ANALYSIS: Most commodities are essential for our modern standard of living, so why are they so volatile?

A paper by the International Monetary Fund titled ‘The Long-Run Behaviour of Commodity Prices:…

A paper by the International Monetary Fund titled ‘The Long-Run Behaviour of Commodity Prices:…

The Lucky Country - January 2023

ANALYSIS: Australian share market shines globally

With its mild weather, beautiful beaches, bountiful natural resources, and economic performance, Australia is often described as the lucky country (…

With its mild weather, beautiful beaches, bountiful natural resources, and economic performance, Australia is often described as the lucky country (…

Let’s discuss Sin Stocks - November 2022

ANALYSIS: As ethical investing grows in awareness we consider the historical outperformance of ethically murky stocks.

The term ESG (Environmental, Social and Governance) was officially coined in a 2…

The term ESG (Environmental, Social and Governance) was officially coined in a 2…

Brain drains and inflation pain - October 2022

ANALYSIS: Key swing factor for NZ's net migration outcome is relative strength between New Zealand and Australian labour markets.

New Zealand net migration has been a hot topic of late. As our econo…

New Zealand net migration has been a hot topic of late. As our econo…

Searching for an edge through dividends - September 2022

ANALYSIS: Companies should be aware of the signals they send with dividend notices.

One of the simplest truisms in investing is that share prices follow profits – on average, over the long term. Perh…

One of the simplest truisms in investing is that share prices follow profits – on average, over the long term. Perh…

Volatility ‘built in’ to investment markets - August 2022

ANALYSIS: No-one likes to forecast a recession, which is odd.

A few years back I read a book by Daniel Kahneman, Thinking Fast and Slow. It coined a phrase that captures the way I think about volatil…

A few years back I read a book by Daniel Kahneman, Thinking Fast and Slow. It coined a phrase that captures the way I think about volatil…

Covid tailwinds unwind for NZ retailers - May 2022

ANALYSIS: The pandemic has played havoc with earnings comparisons but market indicators do not bode well.

The effects of Covid continue to reverberate throughout New Zealand more than two years after…

The effects of Covid continue to reverberate throughout New Zealand more than two years after…

Correction on the cards for fragile housing market - March 2022

ANALYSIS: History suggests the price weakness will have knock-on effects for dwelling consents and property developers.

Where we came from

The boom in New Zealand’s property market has been extremely…

Where we came from

The boom in New Zealand’s property market has been extremely…