Briscoes Rockets into the NZX 50

Published July 2025

What its recent surge says about the investing landscape in New Zealand.

At first glance, the recent surge in Briscoes’ share price might imply a significant earnings beat, takeover speculation, or perhaps a strategic acquisition. However, closer inspection reveals none of these traditional fundamental catalysts were present. Nevertheless, the share price demonstrated remarkable upward momentum, rising from a recent low of $4.20 to $6.23—a striking increase of approximately 45%. This sharp re-rating drove Briscoes’ valuation from a price-to-earnings multiple closely aligned with its historical 10-year average of around 13.5x to a notably elevated level of approximately 19x which is two standard deviations above its historical average. This despite no corresponding improvement in the underlying fundamentals.

Figure 1 – Briscoe’s Price-to-Earnings Multiple Over the Past 10 Years

Source: Octagon Analysis

The catalyst was the quarterly rebalance of the S&P/NZX 50 Index, effective June 23, 2025. Briscoes (BGP.NZ) replaced the Warehouse Group (WHS.NZ), forcing index-tracking funds to buy Briscoes and sell Warehouse shares en masse. Briscoes’ managing director Rod Duke noted analysts had anticipated this event, and market reactions quickly followed suit.

Price Surge for Briscoe vs. Warehouse Slump

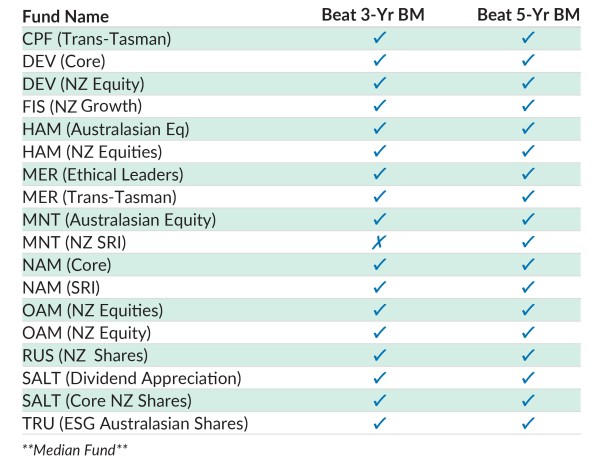

The forced reallocation triggered massive trading volume increases. Briscoes saw turnover surge dramatically to 3.6 million shares in June—nearly ten times its typical monthly average (~390,000 shares in May). Passive funds and ETFs tracking the NZX50 rushed to buy Briscoes shares to reflect the updated index composition. Compounding this effect was Briscoes’ limited liquidity, as Rod Duke personally holds roughly 77% of the shares. With few shares available for trading, index trackers’ buying frenzy significantly inflated Briscoes' price.

Figure 2 – Briscoe’s Share Price Performance and Trading Activity (12-Month Period)

Source: Octagon Analysis

In sharp contrast, Warehouse Group endured heavy selling. Its trading volume in June soared to 8.5 million shares, more than three times May’s 2.6 million. This selling was driven mainly by passive investors compelled to remove WHS from portfolios, pushing its stock price down sharply regardless of underlying business performance. Warehouse shares fell about 18%—from $0.94 to roughly $0.80—making it the worst-performing stock on the NZX50 during June. Moreover, Warehouse had already been struggling over recent years; the forced selling from index exclusion simply exacerbated its decline.

Passive Flows Decouple Price from Fundamentals

These events highlight a critical issue: passive index fund flows can significantly disconnect stock prices from their underlying fundamentals. Briscoes' 45% rise wasn't driven by improved earnings or business outlook, but by a temporary imbalance in supply and demand due purely to passive fund activity.

If I squint my eyes and focus really hard, maybe I can see some fundamentals. The rise in the Briscoes market capitalisation over time (one of the criteria for inclusion in the index) could be a sign of a larger, more sustainable and less volatile business. Those traits could lead to a lower cost of capital and a higher share price. Maybe more analysts will cover the stock and liquidity will increase, that might lead to a more appropriate assessment of risk and growth prospects.

I can assure you the passive investors haven’t done that work – and some likely don’t really care what Briscoes actually does. They just buy at any price, and hope the active managers are pricing the risks correctly. Active investors might have formed a view that WHS was in trouble years ago and sold out, the passive investor waited to be kicked out.

This surge occurred despite a challenging domestic retail environment for Briscoes, with group sales declining 2.6% in the first quarter and the flagship Briscoes brand specifically down 4.7%. Ongoing margin pressures across New Zealand's retail industry would typically suggest subdued stock performance—not the sharp revaluation Briscoes experienced.

Historical parallels exist internationally. In the 1990s, additions to the U.S. S&P 500 index typically prompted 7% stock price increases. But today, such effects are largely arbitraged away, with S&P 500 additions in the last decade averaging only a 0.3% bump. By contrast, smaller, less liquid, and less heavily analysed markets like New Zealand remain susceptible to exaggerated swings driven by passive flows, given fewer active investors and limited liquidity.

Alpha Opportunities for Active Investors

While passive-driven volatility can create challenges, it also offers opportunities for active investors to generate alpha—excess returns above the benchmark. In New Zealand, pronounced index-driven distortions can be exploited through several strategies:

• Anticipating Index Changes:

Proactive investors can buy stocks likely to be included in an index or short those at risk of removal before a rebalance event. Those who anticipated Briscoes’ inclusion could have profited substantially from the stock’s 45% rally.

• Contrarian Trades Post-Rebalance:

Once passive flows fade, active investors can buy fundamentally sound stocks depressed by forced selling or sell overpriced stocks elevated by forced buying. Warehouse’s sharp drop, for instance, may have presented a value-buying opportunity, while investors who sold Briscoes near its peak benefited when its price later corrected by about 13.7%.

• Focusing on Fundamentals:

Given occasional mispricing’s from passive flows, active managers emphasizing intrinsic valuations can consistently identify mispriced securities. This careful analysis can generate strong performance in less-efficient smaller markets.

Evidence of Active Outperformance in New Zealand

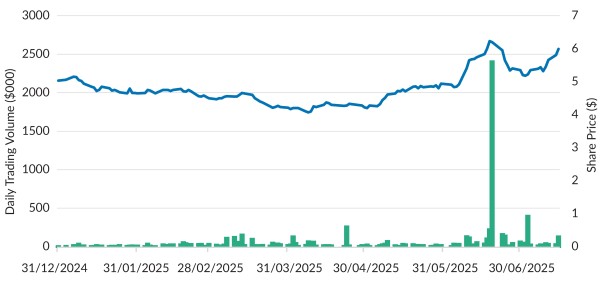

Encouragingly, New Zealand's active fund managers have historically capitalized on these inefficiencies, consistently outperforming the NZX benchmark. Below is a recent snapshot of this success:

NZ Fund Performance vs. Benchmark

(3-Year Benchmark Return: 5.91%, 5-Year Benchmark Return: 2.71%)

Source: MJW Investment Survey June 2025

All NZ active funds beat the NZX benchmark over five years, with only one missing over three years, clearly demonstrating their ability to exploit mispricing.

NZ vs. Global Markets

New Zealand’s market structure, characterized by limited analyst coverage and smaller overall size, amplifies sensitivity to technical flows like index rebalancing. While this sensitivity can cause short-term distortions, it also creates conditions ripe for active management to thrive. Unlike larger international markets saturated with active analysts and liquidity, New Zealand’s environment allows discerning investors to consistently generate excess returns by identifying intrinsic value and trading around passive index flows.

Briscoes’ inclusion in the NZX50 highlights persistent one simple market inefficiency in the New Zealand market, which creates opportunities that active managers can exploit over an extended period. The results seen in the five-year track record of active managers indicates there are many more.

Disclaimer: This article has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. This article does not contain financial advice. Some of the Octagon portfolios own securities issued by companies mentioned in this article.

Related reading

CSL and Fisher & Paykel Healthcare (FPH) were working their…

The last two or three years have seen the Official Cash Rate (OCR), and other short-term interest rates, touch heights not seen since before the …

Fittingly for an industry bu…

The past couple of years have been challenging for domestic bond investors. The Bloomberg N…

The core concept of Environmental, Social, and Governance (ESG) has existed for centuries, dating back to religious codes banning investments in slave labour, through to div…

It is no secret that us New Zealanders love to invest in property as a way of building wealth. …

Kiwi households have almost NZ$250 billion sitting in their bank accounts - that's more than double all of th…

For investors that hold assets denominated in a foreign currency, there is both a direct exposure to exchange rate risk, as well as the price risk of the a…

Octagon looks to enhance the returns for our customers by being an active manager in the markets we invest in. This means, by definition and sty…

Bonds are often seen as less glamorous, less volatile, and basically boring when compared with the high-octane, high-ris…

Diversification is the great free lunch in investing – a …

to streamline the post-election government formation process.

Waiting for Godot, by Irish playwright Samuel Beckett, is a tragicomedy in two act…

More than a half-century ago, in November 1971, the then Prime Minister of New Zealand Keith Holyoake flew to Invercarg…

Say we flip a coin. Heads or tails? Heads – you may carry on exactly as you are now. Tails – 77% of your revenue strea…

How profitable are New Zealand’s banks? Seems a fair question aft…

In a July 2022 article we covered the basics of New Zealand Government inflation-linked bonds; how the…

A paper by the International Monetary Fund titled ‘The Long-Run Behaviour of Commodity Prices:…

With its mild weather, beautiful beaches, bountiful natural resources, and economic performance, Australia is often described as the lucky country (…

The term ESG (Environmental, Social and Governance) was officially coined in a 2…

New Zealand net migration has been a hot topic of late. As our econo…

One of the simplest truisms in investing is that share prices follow profits – on average, over the long term. Perh…

A few years back I read a book by Daniel Kahneman, Thinking Fast and Slow. It coined a phrase that captures the way I think about volatil…

Inflation-linked bonds are another option for income investors.

Today, we’re going to discuss wha…

The effects of Covid continue to reverberate throughout New Zealand more than two years after…

Where we came from

The boom in New Zealand’s property market has been extremely…